How America's Big Three Exchanges Shape Global Markets in 2026

Introduction: Why These Markets Matter to USA-Update Readers

In 2026, the United States remains the gravitational center of global capital, and its major exchanges continue to define how money moves, how companies grow, and how households build and protect wealth. For readers of usa-update.com, who follow developments in the economy, finance, employment, technology, regulation, and consumer trends, understanding the evolving role of the New York Stock Exchange (NYSE), the Nasdaq Stock Market, and the Chicago Board Options Exchange (CBOE) is no longer a specialist pursuit; it is a practical requirement for making informed decisions about careers, investments, business strategy, and even lifestyle choices. These three exchanges now underpin not only Wall Street but also a large share of the economic and financial stories covered across the site, from U.S. economic trends to international market shifts.

By 2026, the combined market capitalization of companies listed on the NYSE and Nasdaq, together with the global reach of CBOE's derivatives markets, represents a dominant slice of global equity and options activity. Their influence extends across North America and into Europe, Asia, and other key regions, shaping how investors in cities from New York and Toronto to London, Frankfurt, Singapore, and Sydney perceive risk and opportunity. As new technologies like artificial intelligence, blockchain, and digital assets transform trading and regulation tightens around transparency and sustainability, these exchanges have become laboratories for financial innovation as well as barometers of trust.

For a business-focused audience in the United States and beyond, the story of these exchanges is ultimately a story about experience, expertise, and institutional authority: how they have earned global confidence, how they are adapting to disruptive change, and how their decisions reverberate through jobs, business formation, consumer spending, and government policy.

The New York Stock Exchange: Heritage, Scale, and Authority

The New York Stock Exchange (NYSE) remains the flagship of American capitalism. Established in 1792 under the Buttonwood Agreement, it has evolved from a small group of brokers trading under a buttonwood tree into the world's largest stock exchange by market capitalization, headquartered at 11 Wall Street in New York City. Over more than two centuries, the NYSE has built a reputation for stability, rigorous standards, and deep liquidity, making it the preferred listing venue for many of the world's most established corporations. Visitors to its official platform can see how it continues to position itself as the premier global marketplace for large-cap companies by exploring the NYSE's market overview.

The NYSE's prestige is rooted in the strength and visibility of its listed companies. Household names such as Apple, Johnson & Johnson, ExxonMobil, Coca-Cola, Pfizer, and Walmart have chosen its listing standards and investor base as the core of their public market strategy. For corporate leaders in the United States, Europe, and Asia, a listing on the NYSE still carries a signaling value that goes beyond access to capital; it conveys adherence to rigorous governance, financial reporting, and shareholder rights frameworks that are closely monitored by regulators such as the Securities and Exchange Commission (SEC). The SEC's own resources help investors and executives alike understand how these standards are enforced, and those interested can review the broader regulatory framework through the SEC's official site.

Unlike many fully electronic exchanges, the NYSE has retained its historic trading floor, staffed by designated market makers and brokers who oversee the opening and closing auctions and manage order imbalances in real time. While the majority of trading volume is now executed electronically through sophisticated matching engines and algorithmic systems, the floor remains a critical part of the NYSE's brand and a tangible symbol of continuity and trust. The hybrid model-combining human judgment with advanced technology-has allowed the exchange to navigate periods of extreme volatility, from the 2008 financial crisis to the pandemic-era market dislocations and subsequent recovery.

Since its acquisition in 2013 by Intercontinental Exchange (ICE), a global operator of exchanges and clearing houses, the NYSE has accelerated its technology modernization. ICE's expertise in futures, energy, and data has allowed the NYSE to integrate advanced risk management tools and market data services, enhancing its value for institutional investors, asset managers, and corporate issuers. Those interested in the broader exchange landscape can examine ICE's diversified operations via the Intercontinental Exchange corporate site, which illustrates how exchange infrastructure has become a global, multi-asset business.

From the perspective of usa-update.com readers, the NYSE's authority matters because it anchors much of the financial news, index performance, and corporate activity that influence employment, consumer confidence, and government revenues. Movements in the Dow Jones Industrial Average and the S&P 500, both heavily populated by NYSE-listed companies, often serve as shorthand for the health of the U.S. economy in daily news coverage. When these indices rise or fall, they affect retirement portfolios, corporate investment plans, and even local tax bases, linking Wall Street's performance with Main Street realities across the United States.

Nasdaq Stock Market: Innovation, Growth, and Technology Leadership

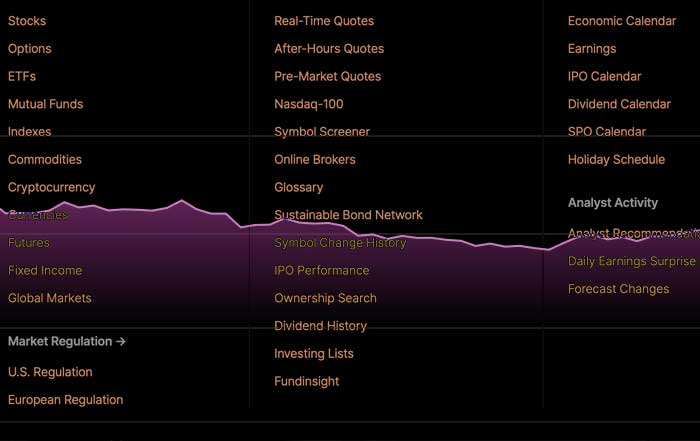

The Nasdaq Stock Market has carved out a distinct identity as the exchange of innovation and growth. Launched in 1971 as the world's first electronic stock market, Nasdaq fundamentally changed how trading works by replacing traditional floor-based auctions with a fully automated dealer system. This innovation allowed for faster execution, tighter spreads, and broader access for broker-dealers and investors, setting the stage for today's high-speed, globally connected markets. The exchange's technology-first ethos is evident on the Nasdaq official site, where it presents itself not only as a venue for listings but as a provider of market technology and analytics to exchanges worldwide.

Nasdaq's brand is closely associated with the digital economy. It is the primary listing venue for many of the world's most influential technology and growth companies, including Microsoft, Amazon, Alphabet, Meta Platforms, Netflix, Nvidia, and Tesla. The concentration of these firms has turned the Nasdaq Composite Index and the Nasdaq-100 into essential benchmarks for global investors tracking innovation, productivity, and the future of work. Performance in these indices often correlates with trends in cloud computing, artificial intelligence, e-commerce, and digital media, all of which shape the broader business and technology narratives covered in usa-update.com's technology section.

From a market structure standpoint, Nasdaq operates as a dealer-based system where multiple market makers quote buy and sell prices, competing to provide liquidity. This model, combined with advanced matching engines and co-location services, has made Nasdaq a preferred venue for algorithmic and high-frequency trading firms that require ultra-low latency. At the same time, Nasdaq has expanded its role as a technology provider, licensing its trading, surveillance, and clearing systems to exchanges and regulators in regions such as Europe, Asia, and the Middle East. This dual identity-as both an exchange and a technology partner-has strengthened its global influence and diversified its revenue beyond trading fees.

Nasdaq has also been at the forefront of corporate governance and ESG-related initiatives. In recent years it introduced board diversity disclosure requirements for listed companies, reflecting growing investor expectations for transparency around leadership composition and social responsibility. This move aligns with broader ESG trends tracked by organizations such as the World Economic Forum, which highlights how sustainability and governance metrics are reshaping capital allocation; those interested can review these themes through the World Economic Forum's insights on sustainable investing. For companies seeking to attract long-term institutional capital, aligning with such expectations is increasingly a strategic necessity rather than a branding choice.

For growth-oriented businesses and entrepreneurs, particularly in sectors like biotechnology, fintech, clean energy, and software, Nasdaq offers an ecosystem that values innovation and scalability. Its listing requirements, while rigorous, are often viewed as more flexible for younger, high-growth firms than the NYSE's, making it a natural destination for initial public offerings (IPOs) from Silicon Valley, Austin, Boston, and emerging tech hubs in Canada, Europe, and Asia. As a result, many of the employment and venture capital stories that surface in usa-update.com's business coverage are directly connected to Nasdaq's pipeline of new listings and capital-raising activity.

Chicago Board Options Exchange: The Engine of Risk Management

The Chicago Board Options Exchange (CBOE) occupies a different but equally critical niche in the U.S. financial ecosystem. Founded in 1973, CBOE pioneered standardized, exchange-traded options, transforming derivatives from bespoke, over-the-counter contracts into transparent, regulated instruments accessible to a broad range of investors. Headquartered in Chicago, it has grown into one of the leading global platforms for options and volatility trading, with products that are now integral to risk management strategies for pension funds, hedge funds, insurers, and sophisticated retail investors.

CBOE's most famous innovation is the CBOE Volatility Index (VIX), often called the "fear index," which measures implied volatility in the S&P 500 based on options prices. The VIX has become a global barometer of market anxiety, spiking during episodes of geopolitical tension, monetary policy uncertainty, or financial stress. Investors, policymakers, and media outlets across the world monitor it as a real-time indicator of risk sentiment, and those seeking a deeper understanding of derivatives and options can explore educational resources through the CBOE's own education center.

Beyond equity options, CBOE has expanded into index options, futures, foreign exchange, and exchange-traded products (ETPs). Its acquisitions of other trading venues and technology platforms have positioned it as a multi-asset exchange group with global reach. The exchange works closely with the Commodity Futures Trading Commission (CFTC) and the SEC to ensure that its complex derivatives products operate within robust risk and compliance frameworks, reflecting the heightened regulatory scrutiny that followed the 2008 financial crisis and subsequent reforms. Those interested in the oversight of derivatives markets can review the CFTC's regulatory mission.

For readers of usa-update.com, CBOE's significance lies in its role as the engine of risk transfer and volatility management that underpins the broader equity markets. Institutional investors use CBOE-listed options to hedge portfolios against downturns, generate income through covered calls, or implement sophisticated strategies around corporate events and macroeconomic data releases. Retail investors, whose participation has surged since the early 2020s, increasingly use options to express directional views or protect positions, although regulators and market educators continue to emphasize the importance of understanding the risks involved. The growth of options trading has become a major storyline not only in finance but also in employment and technology, as firms hire quantitative analysts, data scientists, and software engineers to design and execute these strategies.

How the Three Exchanges Complement and Compete

Taken together, the NYSE, Nasdaq, and CBOE form a tightly linked ecosystem that supports capital formation, trading, and risk management across the United States and beyond. Each exchange has a distinct role, yet their functions overlap and reinforce one another in ways that shape the broader financial landscape followed by usa-update.com readers across finance, employment, and consumer coverage.

The NYSE primarily serves as the home for large, established corporations, emphasizing stability, deep liquidity, and stringent governance standards. Nasdaq positions itself as the hub of innovation and growth, with a strong focus on technology and emerging industries. CBOE specializes in derivatives, providing the tools that allow investors to hedge exposures to NYSE- and Nasdaq-listed equities and indices. This division of labor means that when a technology company lists its shares on Nasdaq, institutional investors may simultaneously trade options on that stock or its sector index on CBOE, while broader market sentiment is reflected in NYSE-driven benchmarks like the S&P 500.

At the same time, there is competition among the exchanges for listings, trading volumes, and new products. Some companies switch listing venues to access different investor bases or branding advantages, and both NYSE and Nasdaq continuously refine their listing standards, fee structures, and market-making incentives to attract high-quality issuers. CBOE, for its part, competes with other derivatives exchanges in the United States and abroad, including those operated by ICE and other global groups. This competitive dynamic drives innovation in market microstructure, technology, and product design, ultimately benefiting investors through tighter spreads, better execution, and more diverse investment tools.

In 2026, this ecosystem is also deeply interconnected with global exchanges. Cross-listings, American Depositary Receipts (ADRs), and international ETFs ensure that developments on the London Stock Exchange (LSE), Hong Kong Exchanges and Clearing (HKEX), Euronext, and other platforms quickly filter into U.S. markets. Analysts and policy makers tracking these linkages often rely on international institutions such as the International Monetary Fund (IMF) and the Bank for International Settlements (BIS), whose data and research, available via the IMF and BIS, underscore the degree to which U.S. exchanges remain central nodes in a dense global network of capital flows.

Stock Exchanges as Drivers of the U.S. Economy

At a macro level, the three exchanges function as core infrastructure for the U.S. economy, enabling companies to raise equity and debt, investors to allocate capital, and governments to monitor and tax financial activity. The ability of firms to list shares, conduct secondary offerings, and issue related securities on the NYSE and Nasdaq supports investment in research and development, manufacturing capacity, digital transformation, and workforce expansion. In turn, these investments generate jobs, productivity gains, and tax revenues that ripple through the broader economy and show up in indicators tracked by institutions like the U.S. Bureau of Economic Analysis (BEA), whose data can be reviewed on the BEA's official site.

The exchanges are also essential to household wealth and retirement security. Pension funds, mutual funds, insurance companies, and individual investors allocate trillions of dollars to equities and ETFs listed on the NYSE and Nasdaq, often using CBOE options to manage risk. The performance of these investments affects consumer confidence and spending, which are closely followed in business and lifestyle coverage on usa-update.com and in economic analysis by organizations such as the Federal Reserve, whose monetary policy decisions, outlined on the Federal Reserve's website, are influenced in part by market conditions on these exchanges.

For corporate America, listing on a major U.S. exchange is both a financing mechanism and a strategic milestone. It enables companies to raise large sums at relatively low cost, diversify their shareholder base, and use stock as currency for mergers, acquisitions, and employee compensation. The visibility and credibility that come with an NYSE or Nasdaq listing can enhance brand recognition in key markets across North America, Europe, and Asia, supporting international expansion and cross-border partnerships. Many of the global business stories that appear in usa-update.com's international section are, in effect, downstream consequences of capital-raising and valuation dynamics that begin on these exchanges.

The world's largest stock exchange by market capitalization, headquartered at 11 Wall Street in New York City.

- Rigorous governance and listing standards

- Historic trading floor with market makers

- Home to blue-chip companies like Apple, J&J, Walmart

- Owned by Intercontinental Exchange (ICE) since 2013

The world's first electronic stock market, known for technology and innovation-focused companies.

- Fully automated dealer-based trading system

- Primary venue for tech giants: Microsoft, Amazon, Tesla

- Leader in ESG initiatives and board diversity

- Global technology provider to other exchanges

The leading global platform for options and volatility trading, headquartered in Chicago.

- Pioneer of standardized exchange-traded options

- Creator of the VIX "fear index" for volatility

- Multi-asset platform: equity, index, FX options

- Critical infrastructure for institutional hedging

Exchange Comparison Matrix

| Feature | NYSE | NASDAQ | CBOE |

|---|---|---|---|

| Primary Focus | Large-cap equities | Tech & growth stocks | Options & derivatives |

| Trading Model | Hybrid (floor + electronic) | Fully electronic | Electronic options |

| Founded | 1792 | 1971 | 1973 |

| Headquarters | New York City | New York City | Chicago |

| Key Companies | Apple, ExxonMobil, Coca-Cola | Microsoft, Amazon, Tesla | VIX, SPX options |

| Market Makers | Designated specialists | Multiple competing dealers | Options market makers |

| Innovation Focus | Stability & governance | Technology & ESG | Volatility products |

| Global Role | Capital formation hub | Tech sector gateway | Risk management engine |

Evolution of U.S. Exchanges

Economic & Social Impact

Employment, Skills, and the Evolving Labor Market

The direct employment footprint of the NYSE, Nasdaq, and CBOE includes traders, brokers, compliance specialists, technologists, data scientists, cybersecurity experts, and market operations staff. Yet their indirect impact on employment is far larger, encompassing roles in investment banking, asset management, legal and accounting services, financial technology, and corporate finance. As companies use the exchanges to access capital, they fund expansions that create jobs in manufacturing, logistics, software development, research, and marketing across the United States and in key partner countries such as Canada, Germany, the United Kingdom, Japan, and Singapore.

The rise of algorithmic trading, AI-driven analytics, and digital platforms has shifted the skill mix required in capital markets. Quantitative analysis, coding, data engineering, and machine learning expertise have become central to trading and risk management, while traditional floor-based trading roles have diminished. This transformation mirrors broader trends in the U.S. labor market, where technology is reshaping job descriptions and career paths. Readers tracking these developments in usa-update.com's jobs and employment coverage can see how demand for advanced technical skills in finance is influencing education choices, professional training, and geographic clustering in cities such as New York, Chicago, San Francisco, and Boston.

The exchanges also affect employment through their role in corporate governance and disclosure. Listing requirements around executive compensation, workforce diversity, and human capital management have pushed many companies to be more transparent about how they recruit, retain, and develop talent. Research from organizations such as the OECD, accessible via the OECD's employment and labor market portal, shows that investors increasingly scrutinize workforce practices as part of ESG analysis, reinforcing the idea that labor issues are not merely operational concerns but material financial factors.

Retail Investors and the Democratization of Markets

Over the past decade, the participation of retail investors in U.S. markets has expanded dramatically, driven by commission-free trading apps, fractional shares, and easy access to market information. Platforms such as Robinhood, Charles Schwab, and E*TRADE have lowered barriers to entry, allowing millions of individuals in the United States and abroad to buy and sell NYSE- and Nasdaq-listed stocks and CBOE-listed options from their smartphones. This shift has made market coverage on usa-update.com more relevant to everyday readers, who now see a direct connection between financial headlines and their own portfolios.

The surge in retail activity has had complex effects. On one hand, it has broadened financial inclusion, giving more households the opportunity to build wealth through equity ownership. On the other hand, episodes like the GameStop and AMC rallies of 2021, fueled by social media and options trading, highlighted the risks of speculative behavior and the potential for sudden volatility. Regulators such as the SEC and the Financial Industry Regulatory Authority (FINRA) have responded with guidance and enforcement actions aimed at ensuring fair access and protecting less experienced investors, and their perspectives can be explored through resources on FINRA's website.

Retail investors are now significant players in both cash equities and options markets, particularly in technology and consumer-discretionary sectors that resonate with everyday experiences. They also increasingly consider ESG factors, sustainability, and corporate values in their investment decisions, aligning with broader shifts in consumer behavior and lifestyle preferences that feature in usa-update.com's lifestyle coverage. As digital education tools and financial literacy initiatives expand, the ability of individual investors to navigate complex products and market cycles will be an important determinant of long-term wealth outcomes.

Regulation, Governance, and Trust

The credibility of U.S. exchanges depends heavily on the strength and consistency of their regulatory environment. The SEC, CFTC, and self-regulatory organizations such as FINRA enforce rules around disclosure, market manipulation, insider trading, and investor protection. The NYSE and Nasdaq impose additional listing standards covering financial reporting, board independence, audit committees, and shareholder rights, while CBOE works under specialized derivatives regulations designed to manage systemic risk. This multi-layered framework is a key reason why global investors continue to view U.S. markets as relatively safe and transparent compared with many alternatives.

From a business perspective, these rules can be demanding and costly to comply with, particularly for smaller firms or companies from jurisdictions with less stringent standards. However, the trade-off is access to deep pools of capital and a broad, sophisticated investor base. Institutions such as the World Bank, whose governance indicators are available on the World Bank's governance portal, have consistently found that strong regulatory and legal frameworks correlate with higher levels of investment and economic growth. For U.S. policymakers and exchange operators, maintaining this balance between protection and competitiveness remains an ongoing challenge.

In 2026, regulatory attention is increasingly focused on issues such as market data fees, payment for order flow, the use of AI and algorithms in trading, and the treatment of digital assets. These debates are not purely technical; they reflect broader questions about fairness, market access, and systemic stability that resonate with the business and consumer audience of usa-update.com, and they influence legislative and enforcement priorities that are tracked in the site's regulation section. The way these issues are resolved will shape how the next generation of exchanges and trading platforms operates.

Global Capital Flows, Cross-Border Listings, and Geopolitics

U.S. exchanges have long been magnets for international capital and foreign company listings. Firms from Europe, Asia, Latin America, and Africa seek NYSE or Nasdaq listings to raise capital, enhance their global brand, and gain credibility with institutional investors. High-profile listings by companies such as Alibaba from China, BP from the United Kingdom, and Samsung Electronics from South Korea have underscored the global appeal of U.S. markets. At the same time, geopolitical tensions, particularly between the United States and China, have complicated this landscape, with audit transparency requirements and national security concerns leading to delisting threats and shifts in listing strategies.

Despite these frictions, the United States remains a preferred destination for cross-border capital, in part because of its deep, liquid markets and strong investor protections. International organizations such as the Organisation for Economic Co-operation and Development (OECD) and the World Trade Organization (WTO), whose analysis is available via the OECD's finance and investment portal and the WTO's trade and finance pages, consistently highlight the central role of U.S. markets in global financial integration. For companies in emerging markets, listing in New York can serve as a bridge to global supply chains, talent pools, and consumer markets, reinforcing the United States' position as both a financial and commercial hub.

For investors based in North America, Europe, and Asia, U.S. exchanges provide convenient access to international diversification through ADRs, global ETFs, and multinational corporations. This access is critical for portfolio construction in an era where economic growth is increasingly dispersed across regions, and it is one of the reasons why global market developments feature prominently in usa-update.com's international reporting. As geopolitical dynamics evolve, the ability of U.S. exchanges to remain open, competitive, and trusted by foreign issuers and investors will be a key determinant of their long-term leadership.

ESG, Sustainability, and the Changing Expectations of Capital

Environmental, Social, and Governance (ESG) factors have moved from the margins to the mainstream of investment decision-making. Large asset managers, pension funds, and sovereign wealth funds now routinely incorporate ESG metrics into their portfolio construction and voting policies. In response, the NYSE, Nasdaq, and CBOE have all developed ESG-related indices, disclosure frameworks, and products, reflecting a broader shift in how capital markets assess risk and opportunity.

The NYSE works with index providers and data firms to support ESG-focused benchmarks and encourages listed companies to improve transparency around emissions, diversity, and governance practices. Nasdaq has taken a more prescriptive stance in some areas, such as board diversity disclosures, while also offering ESG data and analytics services to issuers and investors. CBOE has introduced derivatives linked to ESG indices and climate-related benchmarks, allowing investors to hedge or express views on sustainability themes. These efforts align with global initiatives promoted by organizations like the United Nations Principles for Responsible Investment (UN PRI), whose resources are available on the UN PRI website.

For businesses, meeting ESG expectations is increasingly tied to cost of capital and market access. Companies that lag on climate risk management, labor practices, or governance structures may face higher financing costs or exclusion from major indices and funds, while those that lead can attract long-term, sticky capital. For readers of usa-update.com, this evolution is relevant not only from an investment perspective but also in terms of corporate strategy, regulatory compliance, and even career opportunities in sustainability-focused roles. Coverage in the site's energy and business sections reflects how ESG is reshaping industries from oil and gas to technology and consumer goods.

Digital Assets, AI, and the Future of Trading

Perhaps the most transformative forces reshaping U.S. exchanges in 2026 are digital assets and artificial intelligence. Cryptocurrencies, tokenized securities, and blockchain-based settlement systems have challenged traditional models of trading and custody, while AI and machine learning have revolutionized how market participants analyze data, execute trades, and manage risk.

Traditional exchanges have responded with a mix of caution and innovation. Nasdaq provides market surveillance technology to several cryptocurrency exchanges and has explored ways to integrate digital asset data into its analytics offerings. CBOE has listed futures and options on Bitcoin and other digital assets, bringing these instruments under a regulated umbrella and offering institutional investors a way to gain exposure with standardized contracts. The NYSE has tested blockchain applications for clearing and settlement, seeking to reduce counterparty risk and shorten settlement cycles, in line with broader industry moves toward T+1 or even same-day settlement.

AI is now embedded in nearly every layer of market infrastructure. Exchanges use it to detect suspicious trading patterns, optimize order routing, and manage operational risks, while asset managers and trading firms deploy machine learning models for price prediction, portfolio optimization, and sentiment analysis. The MIT Sloan School of Management and other leading academic institutions, whose research can be explored via the MIT Sloan finance and AI pages, have documented how these technologies are altering market microstructure and competitive dynamics. For workers and students considering careers in finance and technology, these trends underscore the importance of data literacy and cross-disciplinary skills.

At the same time, the rise of AI and digital assets raises new questions about fairness, transparency, and systemic risk. Regulators and exchanges must grapple with issues such as algorithmic bias, model risk, cybersecurity, and the potential for flash crashes driven by automated systems. These concerns are increasingly reflected in policy debates and regulatory agendas that usa-update.com covers in its regulation and finance sections, making the intersection of technology and markets a central theme for business leaders and investors.

Looking Ahead: Opportunities and Responsibilities

In 2026, the New York Stock Exchange, the Nasdaq Stock Market, and the Chicago Board Options Exchange remain foundational institutions in both the U.S. and global financial architecture. Their experience in navigating crises, their expertise in market design and technology, and their authoritativeness in setting listing and governance standards have earned them a level of trust that continues to attract issuers and investors from across North America, Europe, Asia, and beyond. Yet their continued leadership is not guaranteed; it depends on their ability to adapt to evolving technologies, regulatory expectations, geopolitical realities, and societal demands for greater inclusion and sustainability.

For the audience of usa-update.com, these exchanges are not abstract entities. They influence the availability of jobs, the cost of capital for businesses, the performance of retirement accounts, and the direction of innovation in sectors from energy and technology to entertainment and travel, all of which are reflected across the site's coverage in areas such as economy, finance, business, and international affairs. Understanding how the NYSE, Nasdaq, and CBOE operate and evolve provides a clearer lens through which to interpret daily headlines, assess long-term trends, and make informed decisions as an investor, executive, employee, or policymaker.

As markets become more complex and interconnected, the need for reliable information, rigorous analysis, and trustworthy institutions grows. The United States' big three exchanges will continue to serve as critical reference points in that landscape, and usa-update.com will remain a platform where their impact on the economy, jobs, regulation, technology, and consumer life is examined with the depth and perspective that a sophisticated business audience requires.