The story of the United States’ economic history is inseparable from the laws and regulations that have shaped its trajectory. From the early colonial era through the industrial revolution and into the modern digital economy, government policies have influenced everything from banking stability and labor conditions to consumer protections and global trade. Understanding this intertwined history provides clarity not only about the past but also about the challenges and opportunities facing the country today.

This article explores the major economic eras of the United States, the regulatory responses that emerged from crises and growth, and the long-term implications of these policies for innovation, employment, and global competitiveness. It also draws connections to contemporary debates about the role of regulation in areas such as technology, energy, and international finance, making the analysis especially relevant in 2025.

The Colonial and Early Republic Economy

Foundations of Commerce and Trade

The colonial economy of the United States was built upon agriculture, trade, and small-scale manufacturing. Colonists relied heavily on exports of tobacco, cotton, and timber to Europe, while importing finished goods from Britain. Economic policies were largely dictated by mercantilist principles imposed by the British Crown, restricting colonies to trade within the empire.

The Revolutionary War marked a turning point, pushing the new nation to seek financial independence. The Continental Congress issued paper currency, but inflation eroded its value, demonstrating the need for a stable financial system. This set the stage for the debate over central banking that would dominate the early republic.

Hamilton vs. Jefferson

The economic visions of Alexander Hamilton and Thomas Jefferson diverged sharply. Hamilton favored a strong central government, a national bank, and support for manufacturing, while Jefferson promoted agrarian independence and limited federal authority. The creation of the First Bank of the United States in 1791 represented an early experiment in centralized economic management, but political opposition led to its expiration.

Even in these formative years, regulation and economic policy were hotly contested, reflecting enduring tensions between free markets and government oversight.

Industrialization and the Rise of Regulation

The 19th Century Transformation

The 19th century saw the U.S. transform from a primarily agrarian economy into an industrial powerhouse. The expansion of railroads, steel production, and factories reshaped both cities and rural life. This rapid growth, however, also created instability, monopolistic practices, and labor unrest.

Railroads became the lifeblood of commerce, but their pricing practices and consolidation triggered public outrage. The federal government responded with the Interstate Commerce Act of 1887, the first major regulatory law aimed at curbing unfair practices by large corporations.

The Progressive Era

The early 20th century brought the Progressive Era, a period in which regulation expanded significantly. Antitrust legislation, including the Sherman Antitrust Act and later the Clayton Antitrust Act, sought to break up monopolies and restore competition.

Consumer protection also gained momentum. The Pure Food and Drug Act of 1906 was enacted in response to unsafe practices in food and pharmaceuticals, laying the foundation for the modern Food and Drug Administration (FDA).

These reforms demonstrated that government regulation was no longer just a response to crises, but also a proactive measure to balance economic growth with social welfare.

The Great Depression and the New Deal

Collapse of the Financial System

The stock market crash of 1929 and the ensuing Great Depression highlighted the fragility of unregulated financial markets. Bank failures, unemployment, and deflation crippled the economy, forcing the federal government to take unprecedented action.

The New Deal Legacy

Under President Franklin D. Roosevelt, the New Deal introduced sweeping reforms that permanently altered the relationship between government and the economy. The Securities and Exchange Commission (SEC) was created to regulate financial markets and restore investor confidence. The Federal Deposit Insurance Corporation (FDIC) was established to protect bank deposits and prevent mass withdrawals.

Labor protections also expanded through the Fair Labor Standards Act, which introduced minimum wages and maximum working hours. These measures, while controversial, laid the foundation for a more stable and inclusive economy.

Post-War Prosperity and Regulatory Balance

Economic Expansion of the 1950s and 1960s

After World War II, the U.S. experienced a period of extraordinary growth, with rising wages, consumer spending, and suburban expansion. Government regulation during this era focused on sustaining stability while supporting innovation and infrastructure. Programs such as the GI Bill expanded education and homeownership, fueling the growth of the middle class.

Emerging Regulatory Fields

Environmental regulation gained prominence in the 1960s and 1970s, leading to the creation of the Environmental Protection Agency (EPA) in 1970. Consumer rights expanded through laws protecting product safety and truth in advertising. These shifts highlighted how regulation evolved in response to new societal concerns beyond financial stability.

🏛️ U.S. Economic & Regulatory History

Interactive timeline of major economic eras and regulatory milestones

Deregulation and Globalization

The 1980s Shift

The 1980s marked a dramatic turn toward deregulation under President Ronald Reagan. Industries such as airlines, telecommunications, and banking were liberalized to encourage competition and efficiency. While deregulation spurred innovation and lowered costs in some areas, it also set the stage for financial volatility.

The Rise of Global Trade

The signing of agreements like the North American Free Trade Agreement (NAFTA) accelerated globalization, reshaping industries and labor markets. U.S. companies expanded globally, while domestic workers faced new competition. This sparked debates over the role of regulation in protecting national industries versus embracing free trade.

The 2008 Financial Crisis and Regulatory Overhaul

Causes and Consequences

The collapse of the housing market and subsequent financial crisis in 2008 exposed weaknesses in oversight of complex financial instruments such as mortgage-backed securities and derivatives. Millions lost homes, jobs, and savings, prompting a massive government intervention.

The Dodd-Frank Act

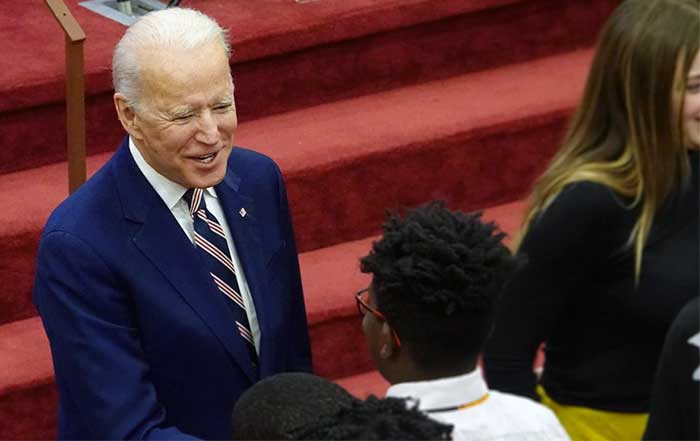

In response, the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 introduced sweeping changes. The Consumer Financial Protection Bureau (CFPB) was created to protect borrowers, while new rules imposed stricter capital requirements on banks.

While some argued these reforms constrained economic activity, others credited them with stabilizing financial markets and preventing future collapses.

The Digital Age and New Regulatory Frontiers

Technology and Privacy

As the economy shifted toward technology and digital platforms, regulation faced new challenges. Issues such as data privacy, cybersecurity, and digital monopolies became central to policy debates. Companies like Google, Amazon, and Meta faced growing scrutiny for their influence over markets and personal information.

Governments introduced new frameworks, such as the California Consumer Privacy Act (CCPA), while at the federal level discussions about comprehensive data privacy laws continued into 2025. Learn more about technology and innovation.

Energy and Climate

Climate change has emerged as a defining regulatory frontier. Policies promoting renewable energy, carbon reduction, and sustainable business practices are reshaping industries. The Inflation Reduction Act of 2022 set ambitious goals for clean energy investment, reinforcing the role of government in steering the future economy. Explore more about energy developments.

The Global Role of U.S. Regulations

International Influence

U.S. regulations often serve as a benchmark for other nations. From financial standards to digital privacy rules, the influence of American policy extends worldwide. The challenge lies in balancing national interests with global cooperation, particularly in areas like international finance and climate policy. See more on international developments.

Competitiveness and Innovation

While regulation can constrain short-term profits, it also creates conditions for long-term trust and stability. Strong consumer protections and transparent financial systems make the U.S. an attractive market for global investors, reinforcing its role as a leading economic power.

Banking and Financial Regulation

The Evolution of American Banking

The history of banking in the United States reflects cycles of expansion, collapse, and reform. The early republic saw experimentation with central banking through the First Bank of the United States (1791–1811) and the Second Bank of the United States (1816–1836). When the latter’s charter was not renewed, the country entered the “Free Banking Era,” in which state-chartered banks operated without federal oversight, leading to instability and frequent bank runs.

The Civil War highlighted the need for greater stability. The National Banking Acts of 1863 and 1864 established a system of nationally chartered banks and created a uniform national currency. Still, without a central lender of last resort, the financial system remained vulnerable to panics.

The Panic of 1907, triggered by the collapse of trust companies, underscored the urgency for reform. The creation of the Federal Reserve System in 1913 provided the United States with a central bank capable of stabilizing markets and responding to crises.

The Glass-Steagall Act and Beyond

After the stock market crash of 1929, the Glass-Steagall Act of 1933 was enacted to separate commercial and investment banking, preventing banks from taking excessive risks with consumer deposits. This separation remained in place for decades until parts of it were repealed in 1999 under the Gramm-Leach-Bliley Act, a move that critics argue contributed to the 2008 financial crisis.

Today, debates continue over the balance between financial innovation and systemic risk. The Dodd-Frank Act of 2010 introduced stress testing for banks, capital requirements, and oversight of derivatives. Its legacy remains contested, but it reshaped how banks interact with consumers and regulators.

Learn more about finance in the U.S. economy.

Labor Regulation and Worker Protections

Industrial Age Labor Struggles

Industrialization in the late 19th century introduced harsh working conditions, long hours, and unsafe environments. Labor unions, such as the American Federation of Labor (AFL), organized strikes to demand fair wages and safer workplaces. Early efforts like the Knights of Labor failed to achieve lasting reforms, but they paved the way for broader protections.

The turning point came in the early 20th century when the federal government began passing labor regulations. The Fair Labor Standards Act of 1938 established minimum wage, maximum working hours, and child labor restrictions. This marked a critical shift in the government’s responsibility to protect workers.

Modern Labor Debates

In the 21st century, labor regulation continues to evolve in response to the rise of the gig economy. Companies like Uber and DoorDash challenged traditional definitions of employment, prompting states like California to pass laws such as Assembly Bill 5 (AB5) to classify gig workers as employees with access to benefits.

These debates echo the longstanding question of how regulation can ensure fairness without stifling innovation. With remote work now widespread, new frameworks for workplace safety, wages, and benefits are being debated at the federal level in 2025. Explore more about employment trends.

Environmental Regulation

The Birth of Environmental Policy

By the 1960s, pollution and environmental degradation became national concerns. Events such as the Cuyahoga River fire of 1969 symbolized the consequences of unchecked industrial growth. Public pressure led to the creation of the Environmental Protection Agency (EPA) in 1970.

Legislation such as the Clean Air Act (1970) and the Clean Water Act (1972) imposed strict standards on pollution, reshaping industries and forcing companies to adopt cleaner technologies. Critics argued that compliance costs burdened businesses, but the long-term health and environmental benefits were undeniable.

The Climate Change Era

In recent decades, the focus has shifted from pollution control to climate change. Policies such as the Paris Agreement influenced U.S. commitments, while the Inflation Reduction Act of 2022 incentivized renewable energy development. These measures demonstrate how government regulation now seeks not only to limit harm but also to actively accelerate the transition to sustainable energy.

Learn more about energy and sustainability.

Technology and Digital Regulation

Antitrust in the Digital Age

Just as the industrial age required antitrust laws to limit monopolies, the digital age has prompted renewed scrutiny of technology companies. Google, Amazon, Apple, and Meta have faced antitrust investigations in the U.S. and abroad. Critics argue that these companies dominate markets, restrict competition, and exploit user data.

Congressional hearings and regulatory proposals have explored options ranging from breaking up companies to imposing stricter data privacy protections. The California Consumer Privacy Act (CCPA) and Europe’s General Data Protection Regulation (GDPR) illustrate the growing momentum toward comprehensive data regulation.

Artificial Intelligence Oversight

By 2025, artificial intelligence has become a central topic of regulation. Concerns over algorithmic bias, job displacement, and national security have led to calls for frameworks governing AI development. The White House Office of Science and Technology Policy has outlined an AI Bill of Rights, while the private sector pushes for innovation-friendly rules.

For insights into technology trends, this debate highlights how regulation must adapt to fast-changing industries without slowing progress.

Energy and Resource Regulation

Oil, Gas, and National Security

The regulation of oil and gas has long been tied to U.S. national security. The oil crises of the 1970s revealed vulnerabilities in foreign energy dependence, prompting the creation of the Department of Energy in 1977. Regulations on fuel efficiency, drilling, and energy exports became central to economic policy.

Renewable Energy Transition

In the 21st century, renewable energy has transformed the regulatory landscape. Tax credits for solar and wind, subsidies for electric vehicles, and federal support for grid modernization are reshaping industries once dominated by fossil fuels. Companies like Tesla have thrived under supportive regulation, while traditional oil firms are adapting to stricter carbon rules.

The future of U.S. competitiveness depends heavily on whether the government can balance energy independence, sustainability, and economic growth.

Consumer Protection and Corporate Accountability

Building Trust in Markets

Consumer protection has been a recurring theme throughout U.S. history. From the Pure Food and Drug Act to the creation of the Consumer Financial Protection Bureau (CFPB), regulations aim to build trust in products and markets.

The 2008 financial crisis reinforced the importance of consumer safeguards, with the CFPB taking a lead role in overseeing credit cards, mortgages, and lending practices. In the digital age, consumer rights extend into areas like online privacy and e-commerce transparency.

Corporate Social Responsibility

Beyond formal regulation, companies are increasingly expected to uphold ethical and sustainable practices. Investors and consumers demand greater accountability in areas such as diversity, climate impact, and governance. Regulation is expanding to enforce disclosures, ensuring that companies align profits with social responsibility.

Events That Redefined Regulation

The Great Depression (1930s): Led to the SEC, FDIC, and stronger labor protections.

1970s Oil Crisis: Prompted fuel efficiency standards and energy independence strategies.

2008 Financial Crisis: Triggered Dodd-Frank and systemic oversight of banks.

COVID-19 Pandemic (2020s): Exposed weaknesses in supply chains, healthcare systems, and labor protections, leading to new regulatory discussions about resilience and preparedness.

Readers can follow more significant events shaping policy.

U.S. Regulations in a Global Context

Comparison with Europe

While the United States has often been described as favoring market-driven solutions, Europe has generally embraced a more interventionist regulatory tradition. The European Union’s General Data Protection Regulation (GDPR), for example, has become the global benchmark for privacy protection, influencing how American companies such as Meta and Microsoft manage user data.

By contrast, the U.S. has yet to adopt a federal equivalent, relying instead on state-level initiatives such as the California Consumer Privacy Act (CCPA). This fragmented approach has advantages in flexibility but creates challenges for companies operating nationwide. In energy and climate policy, Europe has also moved more aggressively with carbon pricing and emissions trading schemes, while U.S. debates continue to focus on balancing competitiveness with environmental responsibility.

Comparison with Asia

In Asia, regulation reflects diverse political and economic systems. China, for instance, has pursued heavy state involvement in its financial, technology, and energy sectors, ensuring government control over industries critical to national security. The U.S., while more market-oriented, increasingly recognizes the strategic dimension of regulation, especially in areas like semiconductors and artificial intelligence, where competition with China is most pronounced.

Meanwhile, countries such as Singapore, South Korea, and Japan showcase hybrid approaches—embracing free-market competition but maintaining robust oversight in technology, finance, and environmental policy. These examples highlight the need for the U.S. to adapt its regulatory framework to remain competitive while upholding democratic values.

Learn more about international economic trends.

Modern Debates in U.S. Regulation

The Balance Between Oversight and Innovation

One of the most persistent debates in 2025 concerns how much regulation is necessary without stifling innovation. Advocates of deregulation argue that industries like biotechnology, renewable energy, and artificial intelligence flourish best with minimal government interference. Opponents contend that history has repeatedly shown how unchecked markets can lead to crises, from the Great Depression to the 2008 financial collapse.

For example, AI regulation is a critical frontier. Proposals to enforce algorithmic transparency and limit surveillance applications are gaining support, but industry leaders warn that excessive restrictions could push innovation offshore. The question remains whether the U.S. can craft smart regulations that encourage growth while safeguarding civil liberties.

Labor and the Gig Economy

The rise of gig platforms has reignited debates about labor protections. Companies defend the flexibility of independent contracting, while worker advocates demand benefits such as healthcare, paid leave, and retirement contributions. States are experimenting with different approaches, creating a patchwork of rules that may eventually force federal intervention.

This echoes earlier chapters in U.S. economic history, when workers sought protections against unsafe factories and exploitative practices. Once again, the country faces the challenge of aligning economic dynamism with social equity.

Climate Regulation and the Energy Transition

Climate policy is another battleground. Supporters of renewable energy regulation argue that investment in solar, wind, and electric vehicles is essential for long-term prosperity and security. Critics warn of higher costs for consumers and industries reliant on fossil fuels.

The Inflation Reduction Act of 2022 remains a focal point, providing tax credits for clean energy adoption. Its long-term success depends on whether private industry continues to scale investments alongside government incentives.

Readers can stay updated with energy policy developments.

Regulation and Global Competitiveness

Attracting Investment

Strong regulation, paradoxically, can make markets more attractive to investors. The transparency of the U.S. financial system, reinforced by bodies like the Securities and Exchange Commission (SEC), reassures global investors that markets operate fairly. This regulatory reputation underpins the dollar’s role as the world’s reserve currency.

Technology Leadership

U.S. leadership in technology also depends on effective regulation. Too little oversight risks public backlash, as seen in concerns about data privacy and misinformation on social media platforms. Too much oversight could slow the pace of innovation, allowing competitors in China or Europe to take the lead. The future of American tech dominance hinges on striking this delicate balance.

Trade and International Relations

Regulation also intersects with trade policy. Tariffs, environmental standards, and labor laws shape how the U.S. engages with partners such as Canada, Mexico, and the European Union. In recent years, trade disputes have highlighted how regulatory differences—especially in agriculture and technology—can escalate into diplomatic challenges.

Learn more about business and trade.

Future Directions for U.S. Regulation

Digital Economy and AI Oversight

Looking ahead, the digital economy will dominate regulatory discussions. Artificial intelligence, quantum computing, and blockchain-based finance introduce both immense opportunity and profound risks. By 2030, regulation will likely include:

Mandatory AI ethics and transparency audits.

Expanded privacy laws modeled after the GDPR.

Oversight of digital currencies to protect consumers and prevent illicit finance.

Sustainability and Energy Policy

Regulation will continue to expand in sustainability, with carbon reduction targets shaping industrial strategies. Energy independence, once defined by oil and gas production, will increasingly depend on renewable infrastructure and smart grids.

Labor and Demographics

As the U.S. population ages, regulations around retirement security, healthcare, and immigration will gain urgency. Immigration policy, in particular, will play a pivotal role in ensuring that the labor force remains dynamic and competitive.

Crisis Preparedness

Finally, the experience of the COVID-19 pandemic demonstrated how unprepared the U.S. was for large-scale disruption. Future regulations will likely focus on supply chain resilience, pandemic readiness, and cybersecurity defense, ensuring the economy can withstand shocks.

Readers can follow updates in news and economy for insights into these shifts.

Closing: Lessons from History and Paths Forward

The economic history of the United States shows that regulation has never been static. It emerges in response to crisis, evolves alongside innovation, and adapts to new social and environmental realities. From Hamilton’s banking vision to Roosevelt’s New Deal, from Reagan’s deregulation to the AI debates of 2025, each era has redefined the balance between free markets and government oversight.

What emerges is a pattern: regulation is not an obstacle to prosperity but a foundation for resilience. Effective oversight has enabled the U.S. to maintain trust in its markets, support workers, protect consumers, and sustain global leadership. Poorly designed or absent regulation, on the other hand, has led to instability and crises.

As the country looks to the future, it faces challenges in climate change, digital privacy, artificial intelligence, and global competition. The lessons of history suggest that the United States can thrive when regulation fosters innovation while ensuring fairness, sustainability, and trust. For readers at usa-update.com, staying informed about finance, employment, international policy, business, and consumer issues is not only a matter of economic interest but of civic importance.

The story of America’s economic history and regulations is ongoing, and its next chapters will be written by how today’s policymakers, businesses, and citizens respond to the complex challenges of tomorrow.