Worries That Biden's $1.4 Trillion Package Might Miss The Target

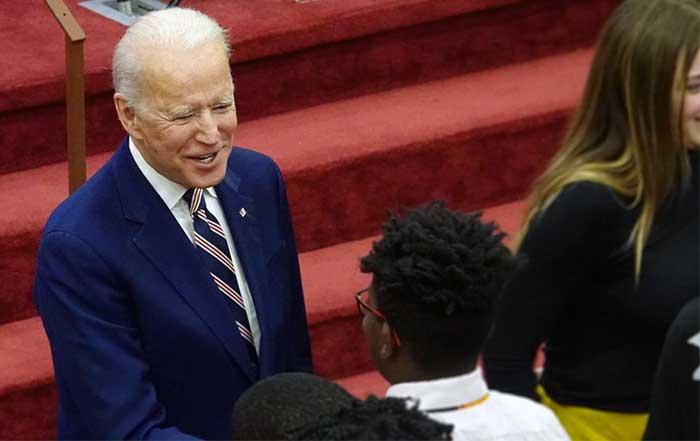

In an unexpected fresh dilemma, US President Joe Biden's much-touted $1.9 trillion economic stimulus package is facing what some have called "a baptism with fire"- running against opposition despite holding promise for millions of desperate Americans battered by the deadly coronavirus effects.

Others fear that the President's well-meaning plan might end up benefitting the "wrong segment of society"- those who don't need it. This means it won't help the much-targeted group- the vulnerable. Despite this, the Biden administration is determined to keep its promise to offer $2,000 payments to vulnerable Americans,, revive a battered economy, and target low-income, unemployed people with this package.

Noting the raging questions and doubts about whether the money would go to the right people, President Biden recently said he's willing to enter a discussion with various stakeholders to ensure those who don't need it don't access the funds. On a positive note, likely, many needy American households will quickly spend the money received. This should instantly boost the economy- we can compare it to a situation where the government uses the payments to pay debts or boost savings. Of course, the latter is far worse.

According to the new administration's official proposals, the government plans to send $1,400 checks to the most vulnerable people- those who've borne the brunt of the pandemic effects for a long time. As noted, the President has already indicated he's willing to discuss eligibility issues with key officials and other parties. Comparatively, the previous round of the stimulus action in December 2020 dispatched $600 checks to those earning a maximum of $75,000- this translates to $150,000 for each of these households.

Interestingly, two studies that recently released their results suggest that the previous income threshold was probably too high to encourage the most spending (relating to the costs). This finding may be factored in against the popular idea that direct payments are primarily useful for boosting economic growth. Regardless of these factors, we should note that policymakers repeatedly advise consumers to limit the spread of the Covid-19 virus primarily by staying at home. This means that -even with direct payment to such vulnerable groups- few of the beneficiaries will readily spend on ordinary activities like traveling or going out for meals. Overall, even with the government's best efforts to reach the vulnerable, it's clear that the checks could still fail to get to many needy households.

In another survey by the US Bureau of Labor Statistics, most Americans would immediately spend their stimulus paychecks. 2/3 of those interviewed said that they'd use the money on food. What does this mean? It clearly indicates that the checks would actually reach the majority of the vulnerable people.

Claudia Sahm, who is a Federal Reserve expert economist on the impact of stimulus payments, said this: "One major issue regarding the matter of narrowing the paychecks is this: the government simply doesn't have all the relevant information. Think of people who lost their jobs only recently. Think of others who had a massive pay cut just the other day. Incredibly, such people may not qualify for the stimulus paychecks. Why? Their situation changed too recently. They are, therefore, unlikely to reach the crucial eligibility threshold. In a nutshell, they won't qualify."

It doesn't end there- you might find that some relatively higher-earning individuals may (ironically) be saving in a limited way, practically living from hand to mouth. Hence, while many beneficiaries may use the money to pay debts instead of saving, the overall effect is that they'll be in a better financial situation than before. This is what economists call "financial resilience." During crisis moments, this is quite important to the dynamics of the broader economy.

Parting shot? Do you seek the biggest bang for your buck? Give the money to those who have the lowest balance in their bank account. Unfortunately, according to Mr. Sahm, the federal government has no such information regarding the potential beneficiaries. Instead, the expert vouches for one-time paychecks, and automatic stimulus payments that he says are way more beneficial. He also warns that the possible fixation with targeting the "right people" might end up denying the same target group of the much-needed resources.