AI, Sustainability, and the New Industrial America: How U.S. Manufacturing Is Being Rebuilt for 2026 and Beyond

A New Industrial Era for the United States

By 2026, the American manufacturing sector has moved decisively beyond its image of smoke stacks, analog control panels, and rigid assembly lines, evolving instead into a complex ecosystem of interconnected, data-driven, and increasingly sustainable operations that sit at the heart of U.S. economic strategy. For the readers of usa-update.com, this transformation is not an abstract narrative but a defining force that shapes national competitiveness, regional job markets, consumer expectations, and global trade relationships. What was once a story about cost-cutting and offshoring has become a story about resilience, technological leadership, and environmental responsibility.

The shift is visible in the way manufacturing now underpins the broader U.S. economy. As regularly highlighted on usa-update.com/economy.html, advanced industries that weave artificial intelligence, robotics, and sustainable practices into their operations are driving a disproportionate share of productivity growth and capital investment. These industries are increasingly seen as strategic assets, not just commercial enterprises, as policymakers and executives recognize that industrial capacity is inseparable from national security, energy independence, and climate policy. American factories are being redesigned as intelligent, cyber-physical systems that learn, adapt, and optimize in real time, while their environmental footprints are scrutinized by regulators, investors, and consumers alike.

This emerging model of manufacturing does not simply modernize existing processes; it redefines what it means to produce value in the twenty-first century. Data has become as critical as steel or silicon, and the ability to orchestrate supply chains with precision rivals the importance of owning physical plants. At the same time, the sector is navigating profound social and workforce implications, as jobs are reshaped rather than simply eliminated, and as communities once written off as part of a "Rust Belt" find new relevance in an era of electric vehicles, semiconductors, and clean energy technologies. For usa-update.com, chronicling this evolution means examining not only the technologies themselves, but also the institutional trust, regulatory clarity, and human capital that determine whether this transformation succeeds.

From Offshoring to Strategic Reshoring and Nearshoring

To understand the depth of the current transition, it is essential to look back at the long arc of U.S. manufacturing policy and corporate strategy. From the 1980s through the early 2000s, globalization and trade liberalization encouraged corporations to move labor-intensive production to lower-cost regions, most notably in Asia. Offshoring became a default strategy for firms seeking to protect margins in an increasingly competitive global marketplace. While this approach yielded short-term savings, it also hollowed out industrial communities across the United States and created structural vulnerabilities in supply chains, as became painfully evident during the COVID-19 pandemic and subsequent geopolitical tensions.

The disruptions of the early 2020s underscored that just-in-time supply chains spread across continents could quickly become fragile under stress. Shortages of semiconductors, medical equipment, and critical minerals revealed how dependent the U.S. economy had become on overseas production hubs. This realization, combined with growing strategic rivalry with China and heightened concerns about energy security and cyber risk, catalyzed a bipartisan shift toward reshoring and nearshoring essential manufacturing capabilities. Measures such as the CHIPS and Science Act and elements of the Inflation Reduction Act (IRA) signaled a new industrial policy paradigm in Washington, one that blends market incentives with targeted public investment to rebuild domestic capacity in sectors deemed critical to national resilience.

For communities across the United States, this has translated into a wave of new plant announcements and expansions, especially in semiconductors, electric vehicles, batteries, and clean energy components. As reported on usa-update.com/news.html, regions that once faced chronic industrial decline are now competing for investments from major corporations and international partners, offering land, infrastructure, and workforce training commitments in exchange for long-term job creation. This reshoring wave is not a simple return to the manufacturing of the past; instead, it is centered on highly automated, AI-enabled facilities that require advanced technical skills and that are designed from the ground up to meet stricter sustainability standards.

Artificial Intelligence as the Central Nervous System of Modern Factories

Artificial intelligence has become the central nervous system of the new American factory, orchestrating operations from the design stage through production, quality control, logistics, and maintenance. The integration of AI into manufacturing is no longer confined to pilot projects; it is embedded in core systems and processes, determining which firms can operate with the speed, precision, and flexibility required in 2026's competitive environment. Companies such as General Electric (GE), Siemens USA, Ford Motor Company, and Caterpillar have invested heavily in machine learning platforms that analyze sensor data from equipment, production lines, and supply chains, enabling predictive maintenance, real-time optimization, and continuous improvement.

AI-driven quality control exemplifies this shift. Instead of relying primarily on human inspectors, manufacturers now deploy computer vision systems trained on vast datasets of images and performance metrics to detect defects that would be invisible to the naked eye. As explored in resources from MIT Technology Review, these systems drastically reduce error rates while accelerating throughput, allowing manufacturers to maintain higher standards even as product complexity increases. Digital twins-virtual replicas of physical assets or entire factories-extend AI's reach further, allowing engineers to simulate process changes, new product introductions, and layout modifications before making costly physical adjustments. In aerospace and defense, where companies such as Boeing and Lockheed Martin must meet exacting safety and reliability requirements, digital twins have become indispensable tools for design validation and risk reduction.

The implications of AI extend well beyond the factory floor. Upstream, AI accelerates product development cycles by enabling generative design, where algorithms propose novel component geometries that maximize performance while minimizing material use. Downstream, AI supports demand forecasting, inventory optimization, and after-sales service, tying manufacturing more tightly to customer behavior and lifecycle management. For readers who follow broader technology trends on usa-update.com/technology.html, the manufacturing sector now stands out as one of the most consequential arenas where AI is moving from theoretical promise to practical, large-scale deployment.

Sustainability as a Core Business and Competitive Imperative

If AI is the brain of the modern factory, sustainability has become its conscience and long-term compass. Environmental, social, and governance (ESG) considerations now shape capital allocation, regulatory compliance, and brand perception in ways that were almost unimaginable a generation ago. Manufacturing accounts for a significant share of U.S. greenhouse gas emissions, and the U.S. Environmental Protection Agency (EPA) has tightened standards on pollutants, energy efficiency, and waste management. In parallel, institutional investors, international partners, and consumers increasingly expect credible decarbonization strategies and transparent reporting.

Companies such as Tesla, Rivian, General Motors, and Ford are not only producing electric vehicles and battery systems; they are redesigning their production facilities to operate with lower carbon intensity, higher resource efficiency, and more circular material flows. Factories powered in part by solar and wind energy, equipped with advanced water recycling systems, and committed to zero-waste targets are becoming reference points for the industry. Global frameworks from organizations like the World Economic Forum and the United Nations Industrial Development Organization provide roadmaps for how manufacturers can align with net-zero targets, implement sustainable procurement, and integrate life-cycle thinking into product design.

For U.S. manufacturers that operate in global supply chains, the pressure to meet European and Asian sustainability standards is particularly intense. The European Union's evolving regulations, including mechanisms similar to a carbon border adjustment, effectively require exporters to demonstrate the carbon footprint of their products. As tracked on usa-update.com/international.html, this has prompted many American firms to adopt more rigorous measurement and verification systems for emissions and resource use. AI and advanced analytics play a key role here as well, enabling real-time monitoring of energy consumption, emissions, and material flows, and supporting optimization strategies that reduce both environmental impact and operating costs.

Industry 4.0 and the Rise of Smart Factories

The convergence of AI, the Internet of Things (IoT), cloud computing, and advanced robotics-often described as Industry 4.0-has reshaped the physical and digital architecture of U.S. manufacturing. Smart factories are characterized by dense networks of sensors embedded in machines, conveyors, and products; high-speed connectivity that feeds data into centralized or edge-computing platforms; and software that continuously analyzes and responds to changing conditions. Rather than operating as isolated plants, these facilities are integrated into broader digital ecosystems that span suppliers, logistics providers, and customers.

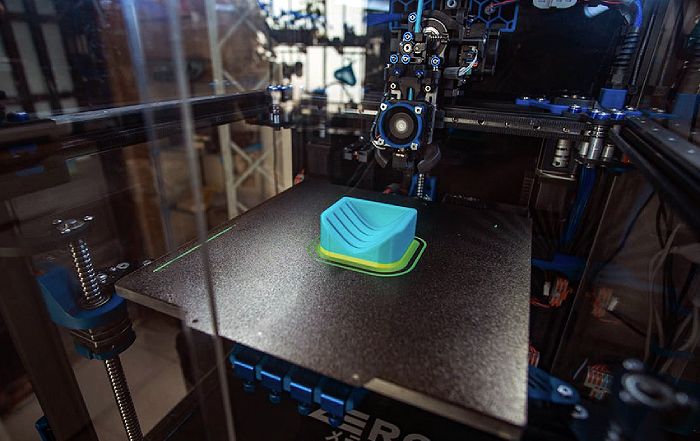

Semiconductor facilities built by Intel in Arizona and Ohio, for example, illustrate how deeply automation and data integration now penetrate critical industries. These fabs coordinate thousands of process steps with nanometer precision, relying on AI to detect anomalies, adjust parameters, and anticipate maintenance needs. The ability to pivot production between different chip designs or end markets-consumer electronics, automotive, defense-confers strategic flexibility at a time when demand patterns are volatile and geopolitical risks are elevated. Similar principles are being applied in battery plants, advanced materials facilities, and large-scale 3D printing operations that are beginning to supplement traditional manufacturing methods.

However, the connectivity that enables smart factories also introduces new vulnerabilities. Cybersecurity has become a board-level concern as ransomware attacks and industrial espionage target operational technology systems. Manufacturers are increasingly partnering with specialized cybersecurity firms and following guidance from bodies such as the National Institute of Standards and Technology (NIST) to harden their digital infrastructure. As covered on usa-update.com/business.html, investment in robust cyber defenses is now considered as essential as investment in physical equipment, because a single breach can halt production, compromise intellectual property, and damage trust with customers and regulators.

Reinventing Supply Chains with Data, AI, and ESG

Supply chain resilience has emerged as a defining theme of post-pandemic manufacturing strategy. The combination of AI, advanced analytics, and ESG priorities is reshaping how companies design and manage their networks of suppliers, logistics routes, and inventory buffers. Rather than optimizing solely for cost, manufacturers now incorporate risk, sustainability, and flexibility into their planning models. AI-driven tools analyze large volumes of data-from macroeconomic indicators to weather forecasts and political developments-to anticipate disruptions and propose mitigation strategies.

Major retailers and logistics-intensive firms such as Walmart and Amazon have been at the forefront of demanding that their suppliers, including U.S. manufacturers, adhere to more stringent environmental and social standards. These expectations cascade through multiple tiers of suppliers, compelling smaller firms to adopt more sophisticated data collection and reporting systems. Research from organizations like McKinsey & Company suggests that companies that successfully integrate AI-based forecasting with sustainable sourcing and logistics can reduce costs, improve service levels, and lower their exposure to shocks such as port closures, energy price spikes, or geopolitical sanctions.

For American manufacturers, this supply chain reinvention intersects with broader international trade trends. As trade agreements increasingly reference environmental standards and digital trade rules, firms that can demonstrate transparent, low-carbon, and ethically managed supply chains enjoy preferential access to key markets. The audience of usa-update.com, particularly those following international developments, will recognize that supply chain strategy has become a core component of corporate diplomacy, with manufacturers needing to balance domestic reshoring priorities against the advantages of diversified global networks.

Workforce Transformation: Skills, Jobs, and Human Capital

The transformation of U.S. manufacturing is as much a human story as a technological one. Automation and AI inevitably change the composition of jobs, but they do not eliminate the need for people; instead, they elevate the importance of specialized skills in programming, data analysis, systems integration, and sustainability management. The U.S. Department of Labor and independent analysts project that advanced manufacturing will continue to generate hundreds of thousands of new roles over the coming decade, many of which require postsecondary education or industry-recognized certifications rather than traditional four-year degrees.

Positions such as AI engineers, robotics technicians, digital maintenance specialists, and ESG reporting managers are increasingly in demand. At the same time, there remains a need for operators and supervisors who can work alongside collaborative robots, interpret dashboards, and respond to complex situations that automation alone cannot resolve. As highlighted on usa-update.com/jobs.html and usa-update.com/employment.html, this evolution presents both an opportunity and a challenge: opportunity, in that manufacturing can again offer well-paid, stable careers in many regions; challenge, in that workers displaced from traditional roles must be reskilled, and education systems must adapt quickly.

Companies are increasingly partnering with community colleges, technical institutes, and universities to develop tailored curricula in mechatronics, industrial AI, and sustainable manufacturing. Organizations such as Siemens USA, Bosch, and Toyota North America have expanded apprenticeship programs that blend classroom learning with on-the-job training, reflecting successful models long used in Germany and other European countries. Workforce development grants from federal and state agencies, along with initiatives supported by the Department of Labor, help lower barriers for workers seeking to transition into these new roles. The degree to which this reskilling effort succeeds will heavily influence whether the benefits of manufacturing's renaissance are broadly shared across regions and demographic groups.

🏭 U.S. Manufacturing Evolution Timeline

From Offshoring to AI-Powered, Sustainable Industry 4.0

Regional Transformations Across the United States

The geography of American manufacturing is being reshaped as AI and sustainability investments flow into different regions, each leveraging its own strengths. The Midwest, long associated with heavy industry, is experiencing a renewed sense of purpose. Cities such as Detroit, Cleveland, and Pittsburgh are positioning themselves as hubs of advanced mobility, robotics, and materials science. Universities like Carnegie Mellon University and University of Michigan collaborate with industry and government to create innovation corridors that link research labs, startups, and large manufacturers. As documented on usa-update.com/employment.html, this revival is fragile unless accompanied by sustained investment in education, infrastructure, and inclusive workforce policies.

In the South, states such as Texas, Georgia, Alabama, and Tennessee have become magnets for large-scale investments in electric vehicles, batteries, and semiconductors. Samsung Electronics, Texas Instruments, Hyundai, Volkswagen, and Nissan have all expanded their manufacturing footprints in the region, attracted by a combination of pro-business regulatory environments, logistics advantages, and growing pools of technical talent. Federal policy priorities around clean energy and strategic technologies, as outlined on The White House, have reinforced these trends by aligning tax incentives and grants with regional development strategies.

The Western United States, particularly California, Arizona, and Nevada, benefits from proximity to leading technology ecosystems and research centers. Intel's fabs in Arizona, along with facilities operated by TSMC and other global players, underscore the region's role in the global semiconductor supply chain. In California, the intersection of Silicon Valley's AI expertise with advanced manufacturing has given rise to startups focused on green robotics, additive manufacturing, and AI-powered logistics platforms. Readers who follow technology coverage on usa-update.com will recognize that these regional clusters are not isolated; they are nodes in a national network that collectively determines the United States' competitive position in the global economy.

Global Competition and Collaboration

The U.S. manufacturing renaissance is unfolding in a world where other nations are aggressively pursuing their own advanced industrial strategies. Germany continues to refine its Industry 4.0 model, emphasizing high-quality engineering, integrated digital platforms, and vocational training. China has pursued its "Made in China 2025" roadmap, investing heavily in AI, robotics, and strategic sectors such as 5G, aerospace, and electric vehicles. South Korea and Japan remain leaders in electronics, precision machinery, and industrial robotics, while countries like Singapore, Denmark, and Sweden leverage strong digital infrastructure and sustainability commitments to attract high-tech manufacturing.

In this context, U.S. manufacturers must compete not only on cost and quality but also on standards, trust, and innovation ecosystems. International collaboration around AI ethics, cybersecurity, and climate goals is increasingly important, as cross-border supply chains and joint ventures require interoperable systems and aligned expectations. As discussed on usa-update.com/international.html, trade agreements and strategic partnerships that recognize shared interests in green technologies, critical minerals, and digital trade will shape the flow of investments and the structure of global markets.

The United States retains significant advantages in research universities, venture capital, and entrepreneurial culture, which support a steady pipeline of innovation in AI, advanced materials, and clean energy. However, these strengths must be matched by consistent policy frameworks, infrastructure investment, and workforce development to translate research breakthroughs into large-scale industrial deployment. The interplay between domestic industrial policy and international diplomacy will determine whether U.S. manufacturers can sustain leadership in sectors such as aerospace, semiconductors, biotechnology, and next-generation mobility.

Policy, Regulation, and Institutional Trust

A central theme that emerges from the coverage on usa-update.com/business.html, usa-update.com/regulation.html, and related sections is that technology alone cannot secure the future of U.S. manufacturing; robust and predictable policy frameworks are equally vital. The CHIPS and Science Act and the Inflation Reduction Act have signaled a renewed willingness by the federal government to use industrial policy tools, including tax credits, grants, and public-private partnerships, to steer investment into strategic sectors. Agencies such as the Department of Energy (DOE) support clean manufacturing technologies, while the Department of Commerce plays a growing role in coordinating semiconductor and supply chain initiatives.

At the same time, regulatory clarity around AI, data privacy, and labor standards will influence how quickly and responsibly companies adopt new technologies. Ethical concerns about algorithmic decision-making, surveillance, and workforce displacement require thoughtful responses from both regulators and industry leaders. Institutions like the Brookings Institution contribute analysis on how to balance innovation with equity, underscoring that long-term trust in AI-enabled systems depends on transparency, accountability, and inclusive governance.

For small and medium-sized manufacturers, the policy environment can be particularly decisive. While large corporations have the resources to invest in AI, cybersecurity, and comprehensive ESG programs, smaller firms often struggle with the upfront costs and skills gaps. Targeted support programs, including technical assistance, low-interest financing, and shared innovation hubs, can help ensure that the benefits of advanced manufacturing are not confined to a narrow tier of global giants. Coverage on usa-update.com/events.html frequently highlights conferences and summits where policymakers, industry executives, labor organizations, and community leaders debate how to design policies that foster both competitiveness and social cohesion.

Consumer Expectations, Lifestyle Shifts, and Brand Trust

Consumer behavior and lifestyle trends are exerting growing influence on manufacturing strategies. As audiences of usa-update.com who follow lifestyle, consumer, and entertainment content know, purchasing decisions increasingly reflect values around sustainability, domestic production, and corporate responsibility. Younger consumers in particular are more likely to research how products are made, where components are sourced, and whether companies treat workers fairly and minimize environmental harm.

Brands that can credibly demonstrate responsible manufacturing practices gain reputational and commercial advantages. Patagonia, while not a heavy industrial player, has become a touchstone for transparency and environmental stewardship, influencing expectations across sectors from apparel to electronics to automotive. In the EV market, buyers increasingly ask not only whether a vehicle produces zero tailpipe emissions but also whether its batteries are manufactured with low-carbon energy and ethically sourced materials. Companies that cannot answer these questions convincingly risk backlash amplified by social media and activist campaigns.

Manufacturers are responding by investing in traceability systems, third-party audits, and more detailed sustainability reporting. Digital tools and blockchain-based platforms are beginning to play a role in verifying claims about origin, carbon footprint, and labor conditions. This transparency is not simply a marketing exercise; it is becoming a prerequisite for access to certain retail channels and international markets. For the business-focused readership of usa-update.com, these developments reinforce the idea that brand equity is increasingly intertwined with manufacturing practices, and that trust must be earned through verifiable action rather than slogans.

Travel, International Mobility, and Manufacturing Hubs

Manufacturing's transformation also has implications for business travel, cross-border collaboration, and regional development, themes that intersect with coverage on usa-update.com/travel.html. As new industrial hubs emerge in the United States, North America, and beyond, executives, engineers, and policymakers travel frequently to coordinate investments, transfer technology, and align standards. Cities that successfully position themselves as centers of advanced manufacturing often see corresponding growth in their airports, hotels, and conference facilities, as they host trade shows, technical summits, and investor roadshows.

At the global level, countries such as Canada, Mexico, Germany, Singapore, and South Korea are deepening their integration with U.S. manufacturing networks, particularly in sectors like automotive, aerospace, and electronics. These relationships depend on reliable physical and digital connectivity, stable regulatory regimes, and mutual recognition of standards. As international travel patterns continue to normalize after the disruptions of the early 2020s, the physical movement of people once again plays a critical role in sustaining the intangible networks of trust and expertise that underpin advanced manufacturing collaborations.

The Road Ahead: Building a Smarter, Greener, More Trusted Industrial Base

Looking forward from 2026, the trajectory of U.S. manufacturing will be shaped by how effectively the country can integrate AI, sustainability, and human capital development into a coherent and trusted industrial strategy. The potential upside is substantial: AI-enabled, low-carbon factories can drive productivity gains, support high-quality jobs, and position the United States as a preferred partner in global supply chains that prioritize resilience and responsibility. Regions that invest in education, infrastructure, and innovation ecosystems are likely to see sustained economic benefits, as manufacturing once again becomes a pillar of local prosperity.

Yet the challenges are equally significant. Ensuring that small and medium-sized enterprises are not left behind, addressing legitimate concerns about job displacement and data privacy, and maintaining international competitiveness in the face of aggressive strategies from other nations will require sustained collaboration between government, business, labor, and civil society. The balance between rapid technological adoption and thoughtful regulation will be delicate, and missteps could erode public trust in both institutions and technologies.

For usa-update.com, this evolving story touches every core area of interest: the economy, finance, business, jobs and employment, technology, international affairs, energy, and consumer behavior. The new industrial America is not a discrete sectoral shift; it is a broad societal transformation that influences how people work, what they buy, how they travel, and how they perceive the country's role in the world.

As manufacturers, policymakers, and communities continue to navigate this transformation, the central questions will revolve around experience, expertise, authoritativeness, and trustworthiness. Which organizations can demonstrate proven capabilities in deploying AI responsibly? Which companies can verify that their sustainability claims are grounded in measurable outcomes? Which institutions can provide reliable guidance in a rapidly changing landscape? By focusing on these questions and providing rigorous, business-focused coverage, usa-update.com aims to serve as a trusted guide for readers seeking to understand and engage with the future of U.S. manufacturing and its impact on the broader economy and society.