Immersive Entertainment in 2026: How Technology, Capital, and Culture Are Rewriting the Global Playbook

Entertainment in 2026 stands at a decisive inflection point, and for the readership of usa-update.com, this moment is not simply about what appears on screens or stages, but about how a powerful, technology-driven ecosystem is reshaping the U.S. and global economy, labor markets, regulation, consumer behavior, and even diplomacy. What began as a steady evolution from live performance to broadcast and then to digital streaming has accelerated into a multidimensional shift toward immersive, interactive, and data-rich experiences that transcend geography and traditional media boundaries. The United States remains a central engine of this transformation, yet it now operates within an increasingly competitive international landscape where Europe, Asia, and fast-growing markets in Africa and South America are asserting their own creative and technological leadership.

For business leaders, policymakers, investors, and professionals who turn to usa-update.com for authoritative coverage of the economy, business, technology, finance, and entertainment, understanding this new entertainment order is no longer optional. It is essential to strategy, risk management, and long-term competitiveness in a world where content, platforms, and audiences are increasingly interconnected.

The Economic Gravity of Entertainment in 2026

By 2026, global media and entertainment have solidified their position as one of the world's most influential economic engines. Industry forecasts from leading consultancies such as PwC and Deloitte indicate that worldwide entertainment and media revenues, which were estimated to exceed $2.8 trillion in 2024, are continuing their upward trajectory, driven by digital consumption, gaming, immersive experiences, and the ongoing globalization of content. Readers who follow macroeconomic trends can contextualize these developments alongside broader U.S. indicators through the economy coverage on usa-update.com.

In the United States, entertainment's contribution to GDP extends far beyond Hollywood studios and streaming platforms. It encompasses production infrastructure, advertising and marketing, live events, sports, gaming, digital content creation, and increasingly, the cloud and semiconductor industries that power immersive experiences. According to analyses from organizations such as the U.S. Bureau of Economic Analysis and the Motion Picture Association, the sector supports millions of direct and indirect jobs, from creative professionals and technical specialists to logistics, hospitality, and tourism workers. Learn more about how high-value creative sectors intersect with employment and wage trends by exploring jobs and employment analysis on usa-update.com.

Entertainment's economic gravity also manifests in its spillover effects. Major releases on platforms like Netflix, Disney+, and Amazon Prime Video can drive tourism to filming locations, stimulate merchandising and licensing deals, and influence consumer electronics demand as households upgrade devices to enjoy higher-fidelity content. In global hubs such as Los Angeles, New York, London, Seoul, and Mumbai, entertainment functions as both a key export and a magnet for talent, capital, and innovation, reinforcing its central role in national competitiveness.

Immersive Entertainment Becomes a Core Growth Engine

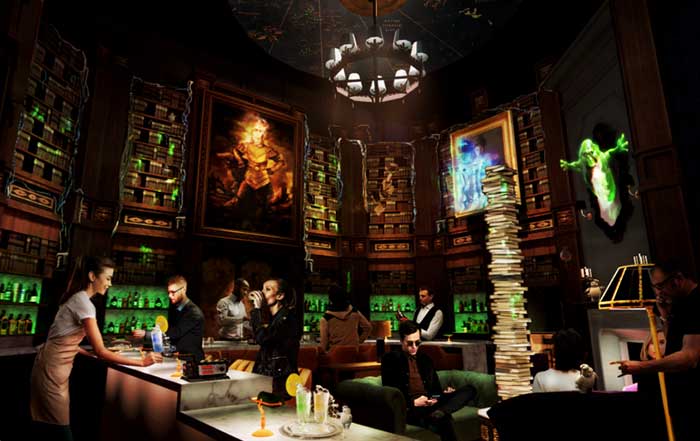

The defining structural shift in 2026 is the mainstreaming of immersive entertainment. Virtual reality (VR), augmented reality (AR), mixed reality (MR), and extended reality (XR) have moved from experimental niches into scalable business lines embedded in the strategies of major technology and media companies. Hardware advances from firms such as Apple, Meta, Sony, and Samsung have produced headsets and glasses that are lighter, more affordable, and integrated with everyday productivity and communication tools, while network improvements and edge computing have reduced latency and enabled richer real-time experiences. For context on the broader technological stack enabling this shift, readers can explore technology trends covered by usa-update.com.

Content, rather than hardware alone, is driving adoption. Disney, Warner Bros. Discovery, Universal Pictures, and leading gaming publishers are investing in immersive story worlds where audiences can move through narrative environments, interact with characters, and influence outcomes. Concerts by global artists, premium sports events, and even corporate conferences are being reimagined as hybrid physical-virtual experiences, with VR and MR layers adding exclusive access, personalization, and data-driven monetization opportunities.

Outside the United States, immersive entertainment is advancing rapidly in regions with robust digital infrastructure and strong gaming cultures. South Korea, Japan, and China continue to lead in social gaming, esports, and avatar-based virtual social spaces, supported by companies such as Tencent, NetEase, Sony Interactive Entertainment, and Nintendo. In Europe, cultural institutions and tourism boards are collaborating with technology partners to create VR reconstructions of historical sites in France, Italy, and Spain, allowing visitors to experience heritage both on-site and remotely. International organizations and think tanks, including UNESCO, have begun to emphasize the role of immersive technologies in preserving and disseminating cultural heritage, underscoring how entertainment is intersecting with education and public diplomacy.

Streaming Matures While the Next Wave Takes Shape

By 2026, the so-called "streaming wars" have evolved into a more complex equilibrium. Global platforms such as Netflix, Disney+, Amazon Prime Video, Apple TV+, and Max (the successor to HBO Max) now coexist with a dense layer of regional and niche services, including Viaplay in Scandinavia, Tencent Video and iQIYI in China, SonyLIV and JioCinema in India, and a rising cohort of platforms in Latin America, the Middle East, and Africa. The U.S. remains the largest single streaming market, but subscriber growth is increasingly driven by emerging economies in Southeast Asia, Africa, and South America, where mobile-first consumption is the norm and local content is crucial to market penetration.

The initial phase of aggressive content spending and subscriber acquisition has given way to a more disciplined focus on profitability, average revenue per user, and churn reduction. Tiered subscription models that combine advertising-supported plans with premium ad-free offerings have become standard, as have strategic bundling arrangements that link video streaming with music, gaming, cloud storage, and other digital services. Analysts at organizations such as McKinsey & Company and KPMG have highlighted the shift from pure scale to sustainable unit economics as a defining feature of the streaming sector's maturation. Readers can delve into the financial implications of these shifts through finance coverage on usa-update.com.

Yet even as streaming stabilizes, its boundaries are blurring. Experiments with VR cinemas, interactive viewing rooms, and synchronized virtual watch parties indicate a steady convergence between streaming and immersive platforms. Sports leagues and concert promoters are partnering with major streamers and technology firms to deliver multi-camera, data-rich, and partially interactive experiences that bridge living rooms, mobile devices, and head-mounted displays. In parallel, generative AI is enabling ultra-personalized content recommendations and even dynamic editing, where scenes or story arcs can be tailored to individual preferences within regulatory and ethical constraints.

Live and Hybrid Events: The Resilience of Physical Experience

Despite the meteoric rise of digital and immersive formats, live events have reasserted their enduring value through 2025 and into 2026. Music festivals, Broadway and West End productions, touring theater, comedy, esports tournaments, and global sporting spectacles have experienced robust demand as consumers seek shared, in-person experiences that cannot be fully replicated virtually. In the United States, landmark venues such as Madison Square Garden, the Hollywood Bowl, and Las Vegas' Sphere have become case studies in how physical infrastructure can be redesigned around immersive technologies, advanced acoustics, and large-scale LED environments to deliver differentiated, premium experiences.

The Sphere in Las Vegas, for example, integrates 360-degree visual canvases, spatial audio, and programmable architecture to create performances that blend live music, cinematic storytelling, and interactive elements. These innovations, documented in coverage by outlets such as The New York Times and The Wall Street Journal, illustrate how capital-intensive venues are positioning themselves as global destinations that attract both tourists and corporate sponsorships. For readers tracking how live events intersect with tourism, hospitality, and transportation, the travel section of usa-update.com provides broader context on mobility and destination trends.

Hybrid models have become the industry standard. Major festivals, conferences, and sporting events now offer layered participation: in-person attendance at premium price points, high-quality streams for remote viewers, and VR or MR enhancements for those seeking deeper immersion. This approach not only diversifies revenue but also expands reach to international audiences in Europe, Asia, and the Americas who may not be able to travel. It also creates ongoing content libraries that can be monetized long after the physical event concludes, reinforcing entertainment's role as a long-tail asset class.

Cultural Shifts, Representation, and Audience Expectations

Entertainment in 2026 is inseparable from broader cultural debates about representation, equity, and authenticity. Audiences in the United States and worldwide have become more vocal and organized in their expectations that media reflect diverse identities and lived experiences. Social platforms and community forums allow viewers to rapidly mobilize around casting decisions, storylines, and corporate behavior, meaning that missteps can trigger reputational and financial consequences in days rather than months.

Major U.S. studios and streamers, including Disney, Paramount, NBCUniversal, Netflix, and Amazon Studios, have introduced diversity and inclusion benchmarks, inclusive writers' rooms, and mentorship pipelines. Industry organizations such as the Academy of Motion Picture Arts and Sciences and the Screen Actors Guild - American Federation of Television and Radio Artists (SAG-AFTRA) have also integrated inclusion criteria into awards eligibility and contractual frameworks. While progress remains uneven, the direction of travel is clear: representation is now a strategic imperative, not a peripheral concern. Readers interested in how these shifts translate into corporate strategy and brand equity can explore business analysis on usa-update.com.

On the global stage, local industries have moved from the periphery to the center of cultural influence. The sustained international success of Korean dramas and K-pop, the global reach of Nigerian Nollywood films and Afrobeats, the growing impact of Latin American series and music, and the continuing power of British, French, and German productions all demonstrate that audiences value culturally specific storytelling with universal emotional resonance. Platforms and distributors that ignore local context or impose homogenized narratives risk irrelevance in markets from Brazil and Mexico to India, South Africa, and the Middle East. Institutions such as the European Audiovisual Observatory and UNCTAD have documented how these industries contribute to national soft power and economic diversification, reinforcing entertainment's expanding policy relevance.

🎬 Entertainment 2026: Global Evolution

Interactive Timeline of Key Sectors & Trends

Technology, AI, and the New Production Paradigm

Technology is no longer an enabler at the margins of entertainment; in 2026 it is the organizing principle of how content is conceived, produced, distributed, and monetized. Artificial intelligence, cloud computing, real-time rendering, and blockchain-based rights management have collectively reshaped the production pipeline, lowering some barriers to entry while introducing new competitive pressures and ethical questions.

AI has become deeply embedded in pre-production and post-production workflows. Generative tools can assist with script ideation, storyboarding, localization, dubbing, and visual effects, allowing smaller studios and independent creators to achieve production values that were once the exclusive domain of major players. Recommendation engines powered by machine learning, refined over years by companies like Netflix, YouTube (owned by Google), and Spotify, now operate at extraordinary levels of granularity, predicting not only what users will watch or listen to but when and on which device. Organizations such as the MIT Media Lab and Stanford Human-Centered AI Institute are publishing influential research on the implications of these technologies for creativity, labor, and regulation, helping decision-makers navigate a rapidly changing landscape.

Cloud-based virtual production, popularized by Epic Games' Unreal Engine and platforms from Microsoft Azure and Amazon Web Services, has redefined how sets, environments, and lighting are created. LED volume stages allow filmmakers and advertisers to shoot in photorealistic, dynamically adjustable settings, reducing the need for on-location shoots and enabling more agile, iterative workflows. This approach, which gained prominence in high-profile productions in the early 2020s, has now diffused into mid-budget projects, branded content, and even corporate communications.

Blockchain and smart contracts are gradually reshaping rights management, royalty distribution, and fan engagement. While the speculative frenzy surrounding non-fungible tokens has subsided, the underlying infrastructure remains relevant for transparent accounting and creator compensation. Musicians, filmmakers, and game developers are exploring token-based models for financing projects and sharing upside with early supporters, while legal frameworks continue to catch up. Readers seeking to understand how these technologies intersect with corporate strategy and capital allocation can find ongoing coverage in the technology and business sections of usa-update.com.

Regulation, Data, and Governance in a Global Market

The globalization and digitization of entertainment have elevated regulatory and governance issues to board-level priorities. In the United States, agencies such as the Federal Communications Commission (FCC) and the Federal Trade Commission (FTC) retain oversight over broadcasting, advertising, competition, and consumer protection, but the rise of global streaming and immersive platforms has created complex cross-border challenges. Data privacy, biometric information collection, algorithmic transparency, and content moderation now sit at the intersection of entertainment, technology, and public policy.

Immersive platforms, in particular, collect highly sensitive data, including eye-tracking, gesture patterns, voiceprints, and in some cases biometric and health-related information. Frameworks such as the California Consumer Privacy Act (CCPA) and the California Privacy Rights Act (CPRA) in the U.S., and the General Data Protection Regulation (GDPR) and Digital Services Act (DSA) in the European Union, have become de facto global standards that shape corporate compliance strategies worldwide. Organizations such as the Electronic Frontier Foundation and Center for Democracy & Technology are increasingly engaged in debates about how to balance innovation with rights protection, highlighting the reputational and legal risks for companies operating in this space. Readers can follow the evolving regulatory environment and its impact on business models through regulation coverage on usa-update.com.

Different jurisdictions are taking divergent approaches to content control and cultural protection. China maintains stringent censorship and data localization requirements, while the European Union enforces content quotas to ensure the prominence of European works on streaming platforms. Countries such as Canada and Australia have introduced or updated legislation to require international platforms to invest in domestic production. These frameworks create a patchwork of obligations that U.S. and global firms must navigate when scaling internationally, influencing decisions on localization, partnerships, and capital deployment.

Employment, Skills, and the Future Creative Workforce

Entertainment has always been a labor-intensive sector, and in 2026 its employment profile is more complex and skills-intensive than ever. The traditional roles of actors, writers, directors, technicians, and craftspeople now coexist with data scientists, AI engineers, virtual production specialists, game designers, UX researchers, and community managers. In the United States, Hollywood remains a powerful employment hub, but major production clusters have also emerged in Atlanta, New York, New Mexico, Texas, and several Midwestern states, supported by tax incentives, studio infrastructure, and local talent pipelines.

Globally, countries with expanding middle classes and improving connectivity are experiencing rapid growth in entertainment-related employment. South Korea's entertainment exports have created a sophisticated ecosystem of production houses, training academies, and marketing agencies. Nigeria's Nollywood and the broader African creative economy have become major employers across the continent, while Latin American markets such as Brazil, Mexico, and Colombia are seeing rising demand for writers, animators, and digital marketers as international platforms invest in local language content. International organizations like the International Labour Organization (ILO) and UNESCO have begun to frame the creative industries as key to inclusive growth and youth employment, particularly in Africa, Asia, and Latin America.

At the same time, automation and AI are transforming job profiles and raising concerns about displacement. Routine tasks in editing, localization, and marketing are increasingly automated, while generative tools can produce drafts of scripts, visual assets, and even music. However, new roles are emerging in AI supervision, ethics, prompt engineering, and digital asset management, suggesting that the net employment impact will depend heavily on training, reskilling, and policy choices. Readers interested in the evolving labor market and skills requirements can explore employment and jobs coverage on usa-update.com, which situates entertainment within broader workforce transformations.

Capital, Investment, and Financial Engineering in Entertainment

The financial architecture of entertainment has become more sophisticated and globalized. Venture capital, private equity, sovereign wealth funds, and institutional investors are all active participants in funding content, platforms, and infrastructure. U.S. public markets continue to host some of the world's largest entertainment and technology companies, from Disney, Comcast, and Paramount Global to Apple, Alphabet, Amazon, and Microsoft, whose valuations are heavily influenced by their media and content strategies. Analysts at institutions such as Goldman Sachs, Morgan Stanley, and Bank of America regularly highlight entertainment and interactive media as key growth drivers within the broader communications and technology sectors.

Immersive entertainment startups focusing on VR concerts, virtual event platforms, spatial computing tools, and metaverse-adjacent experiences have attracted significant funding, even as investors have become more discerning after earlier hype cycles. Traditional media conglomerates are acquiring or partnering with these firms to accelerate their own transformation and avoid disintermediation. Meanwhile, independent creators and smaller studios are experimenting with crowdfunding, revenue-sharing platforms, and token-based financing to reduce reliance on legacy gatekeepers. For readers monitoring capital flows, valuations, and M&A activity, the finance and business sections of usa-update.com provide ongoing insight into how money is reshaping the entertainment landscape.

Internationally, sovereign wealth funds from the Middle East, Asia, and Europe have become major backers of large-scale projects, including theme parks, sports leagues, film funds, and streaming ventures. Partnerships between U.S. studios and investors from the United Arab Emirates, Saudi Arabia, Qatar, and Singapore illustrate how entertainment is viewed as both a financial asset and a strategic tool for tourism, national branding, and economic diversification. This cross-border capital movement further binds entertainment to geopolitics and long-term policy planning.

Social Media, Influencers, and the New Audience Architecture

Social media has evolved into the connective tissue of the entertainment ecosystem. Platforms such as TikTok, Instagram, YouTube, and X (formerly Twitter) shape discovery, fan engagement, and monetization, often determining which films, series, songs, or games become breakout successes. In 2026, short-form video remains a dominant format, with TikTok-driven trends capable of propelling independent artists to global recognition within days. At the same time, long-form content on YouTube and podcasting platforms continues to gain traction as audiences seek deeper engagement with creators and topics.

Influencers and creators have become key strategic partners for studios, labels, and game publishers. Collaborations range from promotional campaigns and early access previews to co-created content and shared IP development. Platforms like Patreon, Substack, and OnlyFans have demonstrated that direct-to-fan monetization can generate substantial income for niche creators, encouraging established entertainment brands to explore similar membership and subscription models. Community-centric platforms such as Discord provide infrastructure for fan communities that operate as always-on focus groups, marketing channels, and even co-creation spaces. Readers can follow how these dynamics intersect with consumer behavior and media consumption in the news and consumer sections of usa-update.com.

For businesses, the rise of creator-driven ecosystems poses both opportunity and risk. On one hand, influencers can deliver highly targeted reach and authentic engagement. On the other, reputational risks, platform dependency, and shifting algorithms can disrupt carefully crafted campaigns. Data literacy, agile marketing, and robust governance frameworks are therefore becoming critical competencies for entertainment executives and brand partners alike.

Sports, Gaming, and the Convergence Megatrend

Sports and gaming have emerged as central pillars of the new entertainment order. Major U.S. leagues such as the NFL, NBA, MLB, and MLS have embraced immersive technologies, advanced analytics, and direct-to-consumer streaming to deepen fan engagement and diversify revenue. VR seat upgrades, interactive statistics overlays, and integrated betting features are increasingly common, particularly as legalized sports wagering expands across North America. Global governing bodies like FIFA, the International Olympic Committee, and regional confederations are experimenting with similar enhancements to maintain relevance among younger, digitally native audiences.

Esports, once viewed as a niche subculture, now competes with traditional sports for viewership, sponsorship, and venue bookings. Tournaments for titles developed by Riot Games, Activision Blizzard, Valve, and others fill arenas from Los Angeles and Berlin to Seoul and Shanghai, while streaming platforms such as Twitch and YouTube Gaming provide global reach. In markets like Brazil, South Korea, and China, esports athletes and streamers have become mainstream celebrities, blurring the line between sports, entertainment, and influencer culture. Organizations such as the Entertainment Software Association (ESA) and Newzoo regularly publish data highlighting gaming's status as the largest entertainment segment by revenue, underscoring its strategic importance.

Gaming has also become the nexus where film, television, music, fashion, and social networking converge. Titles such as Fortnite, Roblox, and Minecraft function as platforms where brands host concerts, film premieres, fashion drops, and interactive storytelling experiences. These environments are early indicators of how metaverse-style ecosystems may evolve: as persistent, user-generated, and commerce-enabled spaces that integrate multiple entertainment modalities. For insights into how such convergence is reshaping events and experiential marketing, readers can explore events coverage on usa-update.com.

Sustainability, Energy, and the Environmental Footprint of Entertainment

The environmental impact of entertainment has moved from a peripheral concern to a central strategic challenge. Large-scale film and television production, global touring, data-intensive streaming, and energy-hungry gaming and immersive platforms all contribute to carbon emissions and resource consumption. By 2026, streaming accounts for a significant share of global internet traffic, with data centers and content delivery networks drawing substantial electricity, much of which is still generated from non-renewable sources in many regions.

Industry leaders are increasingly aware that long-term license to operate depends on addressing these issues. Companies such as Netflix, Amazon, Microsoft, and Google have announced various timelines for achieving net-zero emissions or 100 percent renewable energy usage across operations, while studios and production houses are adopting sustainable production guidelines that focus on travel reduction, set material recycling, and energy-efficient lighting. Music festivals in North America and Europe have begun implementing renewable power solutions, public transportation incentives, and circular waste systems to reduce their environmental footprint. Organizations like the Green Production Guide, BAFTA's albert initiative, and the Science Based Targets initiative provide frameworks and benchmarks for measuring progress.

Immersive experiences and data-rich platforms add complexity to this equation, as higher fidelity and lower latency often require more computing power. At the same time, virtual events and digital tourism can substitute for some physical travel, potentially offsetting emissions if managed thoughtfully. Policymakers, investors, and corporate boards are increasingly asking for transparent reporting on these trade-offs. Readers can explore how sustainability and energy policy intersect with entertainment and technology in the energy section of usa-update.com, which situates these developments within broader climate and infrastructure debates.

Entertainment as Cultural Diplomacy and Soft Power

Entertainment has long functioned as a vehicle of soft power, shaping international perceptions of nations and cultures. In 2026, the United States continues to wield significant influence through Hollywood films, U.S. television, music, gaming, and social media platforms, but it now operates in a far more multipolar cultural environment. South Korea's Hallyu Wave, Japan's anime and manga, India's Bollywood and regional cinemas, Nigeria's Nollywood, and Latin American music and series have all developed substantial global followings, creating multiple centers of cultural gravity.

Governments and cultural agencies are increasingly deliberate in leveraging entertainment as part of their foreign policy and economic development strategies. South Korea's Ministry of Culture, Sports and Tourism, France's Centre National du Cinéma et de l'Image Animée (CNC), and the British Council are among the institutions that support international co-productions, festivals, and artist exchanges. Multilateral events such as the Cannes Film Festival, Berlin International Film Festival, Venice Film Festival, and major music and arts festivals serve as platforms where creative diplomacy unfolds. For readers tracking these intersections between culture, geopolitics, and trade, the international coverage on usa-update.com offers a broader lens on how entertainment fits into global strategy.

For the United States, sustaining cultural leadership will require not only scale and marketing prowess but also openness to collaboration, respect for local narratives, and commitment to ethical practices in data, labor, and representation. Co-productions with partners in Europe, Asia, Africa, and Latin America, multilingual content strategies, and investments in local talent development are becoming critical components of long-term soft power.

Looking Toward 2030: Strategic Implications for U.S. and Global Stakeholders

As the industry looks beyond 2026 toward 2030, several trajectories appear particularly consequential for decision-makers who rely on usa-update.com to inform strategy.

First, immersive and interactive formats are likely to move from premium add-ons to default modes of consumption in many segments. News, sports, education, and corporate communications are already experimenting with 3D and spatial interfaces, suggesting that the boundary between entertainment and other forms of content will continue to erode. Executives will need to plan for capital expenditures in immersive infrastructure, partnerships with technology providers, and new forms of audience measurement that capture engagement in three dimensions.

Second, AI-generated and AI-assisted content will proliferate, raising complex questions about intellectual property, authenticity, and labor. Legal frameworks and industry standards will need to evolve to address issues such as synthetic likeness rights, deepfake misuse, and the attribution of creative credit. Organizations such as the World Intellectual Property Organization (WIPO) and national copyright offices are already engaged in these debates, and their decisions will have far-reaching implications for business models and risk management.

Third, the fragmentation and regionalization of regulation will require sophisticated compliance architectures. As data, content, and competition laws diverge across the United States, European Union, United Kingdom, China, India, and other jurisdictions, companies will need to build adaptable governance frameworks and invest in legal and policy expertise. The costs of non-compliance, in terms of fines, operational restrictions, and reputational damage, are rising.

Fourth, the workforce implications of technological change will demand proactive planning. Entertainment companies, educational institutions, and policymakers will need to coordinate on reskilling and upskilling programs that prepare workers for roles in virtual production, AI-enabled workflows, and cross-platform storytelling. Those who anticipate these shifts and invest early in human capital will be better positioned to capture value and mitigate social risk. Readers can continue to track these evolving dynamics through employment and jobs reporting on usa-update.com.

Finally, the integration of sustainability into entertainment strategy will move from voluntary leadership to baseline expectation. Stakeholders across the value chain, from investors and regulators to consumers and employees, will increasingly demand credible climate and social responsibility commitments. Companies that align immersive innovation with energy efficiency, responsible data practices, and inclusive storytelling will be best positioned to thrive in this new environment.

Conclusion: Entertainment as a Strategic Lens on the Future

For the audience of usa-update.com, entertainment in 2026 is not merely a leisure category; it is a powerful lens through which to understand the evolution of the U.S. and global economy, technological innovation, labor markets, regulatory regimes, and cultural diplomacy. The sector's shift toward immersive, interactive, and data-driven experiences encapsulates broader transformations that are reshaping how societies work, communicate, and define value.

The United States continues to play a pivotal role in this transformation, anchored by its unique combination of creative talent, capital markets, technological infrastructure, and entrepreneurial culture. Yet the rise of strong creative ecosystems across Europe, Asia, Africa, and Latin America means that leadership will increasingly depend on collaboration, adaptability, and respect for diverse voices. As entertainment becomes more deeply embedded in daily life, from personalized media feeds and virtual events to global sports and gaming platforms, its strategic significance will only grow.

usa-update.com is positioned to follow this story as it unfolds, connecting developments in news, business, technology, entertainment, consumer behavior, and the broader economy. For executives, investors, policymakers, and professionals, paying close attention to the entertainment sector is no longer optional; it is a prerequisite for understanding how innovation, culture, and commerce will intersect in the years leading up to 2030 and beyond.