America's Dictionaries in 2026: Language, Power, and the Business of Meaning

Dictionaries in the United States have always been more than alphabetical lists of words; they have functioned as cultural barometers, economic assets, educational foundations, and, increasingly, digital infrastructures that quietly underpin daily life and commerce. In 2026, as artificial intelligence, global markets, and hybrid work reshape how people communicate, the role of dictionaries has expanded from static reference works to dynamic, data-driven platforms that influence everything from regulatory language to international dealmaking. For the audience of usa-update.com, whose interests span economy, news, business, technology, and international affairs, understanding how American dictionaries have evolved offers a revealing lens on how knowledge, authority, and trust are negotiated in a complex, interconnected world.

While the iconic names remain familiar-Merriam-Webster, Oxford University Press, and American Heritage still anchor the market-their products and strategies look very different from the thick hardcovers that once defined the genre. These organizations now operate sophisticated digital ecosystems, selling data licenses, embedding services into productivity platforms, and shaping the linguistic backbone of AI tools that power global communication. At the same time, they face new pressures: the speed of online slang, the politicization of terminology, and the risk that generative AI could erode their visibility even as it relies on their work. The story of dictionaries in 2026 is therefore not only about language; it is about business models, regulatory implications, cultural authority, and the future of information integrity.

From Noah Webster to the Platform Era

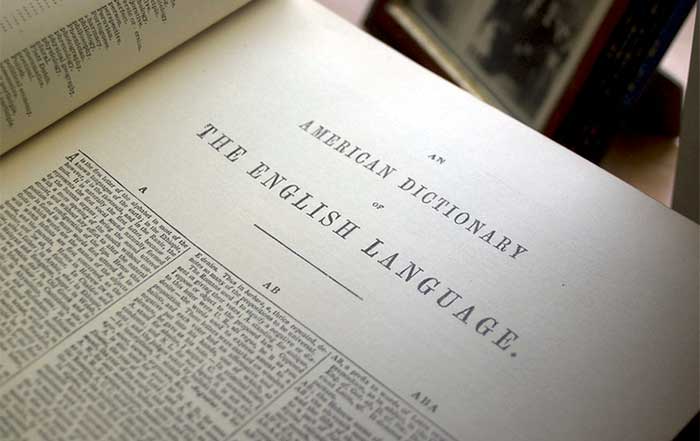

The modern American dictionary story begins with Noah Webster, whose 1828 "An American Dictionary of the English Language" helped codify a distinct American linguistic identity by standardizing spellings and usage that diverged from British norms. In a young republic seeking cultural independence, Webster's choices-"color" over "colour," "defense" over "defence"-were not mere orthographic preferences but expressions of national self-definition. His work fortified literacy at a time of territorial expansion and mass education, and it laid the foundation for the brand that would later become Merriam-Webster, one of the most trusted names in American reference publishing.

Two centuries later, the legacy of Webster's project has migrated into a digital environment in which authority is no longer signified by the weight of a volume but by the reliability, speed, and reach of an online service. Merriam-Webster's transition from print to digital, mirrored by competitors such as Oxford University Press and Houghton Mifflin Harcourt, publisher of The American Heritage Dictionary of the English Language, encapsulates the broader transformation of reference publishing into a data and services industry. Where Webster manually compiled citations, contemporary lexicographers now work with vast corpora of text and speech, algorithmic tools, and user analytics, yet they pursue a similar mission: to capture living language while maintaining standards that educators, courts, and businesses can trust.

For readers of usa-update.com, who regularly follow developments in finance, employment, and regulation, this historical continuity combined with technological transformation illustrates how traditional institutions can reinvent themselves without abandoning their core purpose. Dictionaries are no longer simply books; they are platforms that encode norms, support decision-making, and quietly shape how contracts, policies, and cross-border negotiations are drafted and interpreted.

A Competitive Landscape of Lexicographic Authority

The American dictionary market has long been defined not by a single arbiter but by a constellation of authoritative voices. Alongside Merriam-Webster, Oxford University Press has built a strong presence in the United States through its American English dictionaries and through the global prestige of the Oxford English Dictionary, which documents historical usage in extraordinary depth. The American Heritage Dictionary, introduced in 1969, distinguished itself with usage notes and a panel of experts, offering guidance on disputed constructions that appealed to editors, academics, and professional writers.

This plurality of authorities has had important consequences for American culture and business. Rather than imposing a single, monolithic standard, the coexistence of multiple dictionaries has fostered a more nuanced understanding of language as a spectrum of registers and contexts. Legal practitioners, for example, may consult several sources when interpreting contested terms in contracts or legislation, while publishers and media organizations often adopt a preferred dictionary as part of their house style, supplementing it with specialized glossaries. The Associated Press and The New York Times, for instance, maintain detailed stylebooks that interact with dictionary entries but also override them when editorial policy demands.

In the corporate world, multinational firms with operations in the United States, Europe, and Asia frequently standardize on American English dictionaries to harmonize documentation, training materials, and technical specifications. As sectors such as pharmaceuticals, aviation, and financial services operate under stringent regulatory oversight, consistency of terminology can carry direct legal and economic implications. Businesses that follow best practices in documentation often align with resources such as the Chicago Manual of Style in combination with a primary dictionary, thereby embedding lexicographic authority into operational risk management.

Digital Dictionaries as Infrastructure in 2026

By 2026, the shift from print to digital is effectively complete in the mainstream dictionary market, even though printed volumes still occupy ceremonial and archival roles in libraries and schools. The real action occurs online and in applications, where dictionaries operate as always-on services integrated into broader platforms. Merriam-Webster Online and the Oxford English Dictionary exemplify the modern model: beyond definitions, they provide historical timelines, audio pronunciations, example sentences drawn from real-world usage, and curated features such as "Word of the Day," which has become a staple of email inboxes and social media feeds across the United States and beyond.

The democratizing effect of this digital availability is significant. Learners in rural American communities, professionals in Canada or Singapore, and students in Germany or Brazil can access the same high-quality resources at minimal or zero marginal cost. Public libraries, many of which have expanded digital services since the pandemic years, negotiate institutional licenses that allow cardholders to use premium dictionary content remotely. Organizations such as the American Library Association advocate for equitable digital access, recognizing that vocabulary and comprehension remain critical determinants of educational and economic opportunity.

For the business-oriented readership of usa-update.com, it is notable that dictionaries now function as quiet infrastructure within productivity ecosystems. Word processors like Microsoft Word and Google Docs rely on dictionary data for spell-checking and grammar suggestions, while writing-assistance tools such as Grammarly and ProWritingAid draw on lexicographic databases to improve contextual recommendations. Collaboration platforms used across hybrid workplaces, from Slack to Microsoft Teams, embed dictionary lookup features that support clear communication in real time. In effect, dictionaries have moved from the periphery of the office bookshelf into the center of digital workflows, becoming invisible yet indispensable components of everyday professional life.

Education, Literacy, and Workforce Readiness

The integration of dictionaries into educational technology has reshaped how American students encounter and internalize language. Learning management systems used in K-12 and higher education increasingly incorporate embedded dictionary APIs, enabling learners to click or tap on unfamiliar words in digital textbooks and immediately access definitions, example sentences, and even short etymologies. Platforms such as Google Classroom and widely used e-textbook solutions rely on this functionality to support differentiated learning, particularly for students whose first language is not English.

At the same time, language-learning applications, including Duolingo, Babbel, and Rosetta Stone, collaborate with dictionary publishers or license their data to ensure that vocabulary instruction reflects current usage rather than outdated or overly formal phrasing. Research from organizations such as the National Assessment of Educational Progress continues to underscore the link between vocabulary depth and reading comprehension, and districts that invest in robust digital reference tools often see improvements in standardized test performance and graduation readiness.

These educational developments connect directly to themes of employment and jobs that are central to usa-update.com. Employers across sectors-from advanced manufacturing in the American Midwest to financial services hubs in New York, London, and Singapore-increasingly expect workers to interpret complex documentation, follow precise procedures, and communicate clearly with colleagues and customers around the world. Dictionaries, while rarely mentioned in workforce policy debates, contribute to this readiness by supporting literacy and by standardizing the technical vocabulary used in vocational training, community college programs, and professional certifications. In a labor market where miscommunication can lead to safety incidents, compliance failures, or reputational damage, the quiet work of lexicography underpins both individual career prospects and organizational performance.

Language as a Mirror of Social and Economic Change

Dictionaries have always reflected social change, but the pace and visibility of that reflection have accelerated in the digital age. In the 20th century, new terms entered mainstream dictionaries after years of print usage; in the 2020s, emerging expressions tied to technologies, social movements, or economic trends may be tracked in real time and evaluated for inclusion within months. Words related to artificial intelligence, such as "large language model," "AI hallucination," and "prompt engineering," now appear in authoritative references, alongside terminology from climate policy ("net-zero," "carbon budget"), digital finance ("stablecoin," "DeFi"), and online culture ("doomscrolling," "quiet quitting").

Publishers like Merriam-Webster have turned their annual "Word of the Year" announcements into widely covered media events, with choices often reflecting the anxieties and priorities of a given period. News outlets from NPR to the BBC analyze these selections as indicators of public discourse, while social media users debate whether the chosen word captures the zeitgeist. In an era when attention is a scarce commodity, dictionaries have found a way to make linguistic analysis part of the broader entertainment and news cycle, a trend that aligns with the interests of usa-update.com readers who follow entertainment and cultural developments as closely as economic data.

The incorporation of slang and identity-related terminology has also placed dictionaries at the center of cultural debates. Terms linked to gender identity, race, and political polarization often generate controversy when they are added or when definitions are revised to reflect evolving usage. Lexicographers, drawing on corpora and expert consultation, emphasize that their role is descriptive rather than prescriptive: they document how communities use language rather than dictate how they should. Yet for policymakers, educators, and business leaders, these definitional changes can influence diversity and inclusion policies, marketing strategies, and even legal arguments. The process by which a term moves from subculture to mainstream dictionary entry thus has tangible implications for corporate governance and public policy.

Evolution of American Dictionaries

From Print Legacy to Digital Infrastructure

Dictionaries, Law, and Regulation

Few sectors depend on precise language as heavily as law and regulation. In the United States, courts at every level routinely consult dictionaries when interpreting statutes, contracts, and constitutional provisions, particularly when legislative history is ambiguous or silent. The U.S. Supreme Court has cited dictionary definitions in numerous landmark cases, and justices sometimes debate which dictionary edition or time period offers the most relevant snapshot of meaning. Resources such as Cornell Law School's Legal Information Institute provide open access to opinions and highlight how judges use lexicographic evidence in their reasoning.

For regulators in areas such as financial services, environmental protection, and consumer safety, definitional clarity can determine the scope and enforceability of rules. Terms like "fiduciary duty," "material risk," or "greenwashing" must be understood consistently by market participants across North America, Europe, and Asia. Agencies often draw on dictionary definitions when drafting regulations or guidance documents, and industry groups may submit comments proposing alternative interpretations. This interplay underscores why dictionaries matter to readers who follow regulation and consumer issues on usa-update.com: the meanings codified in reference works can affect compliance obligations, litigation exposure, and strategic planning.

Internationally, organizations such as the International Organization for Standardization and the Financial Stability Board rely on careful terminological work when developing frameworks that must be applied across legal systems and languages. While these bodies often create their own glossaries, the underlying sense of terms is nonetheless informed by general-purpose dictionaries and by the global dominance of American English in business and technology. As cross-border data flows and digital trade intensify, the demand for harmonized definitions will only grow, reinforcing the centrality of lexicographic expertise in the architecture of global governance.

The Economics and Business Models of Modern Dictionaries

Behind the cultural significance of dictionaries lies a sophisticated business reality. The major players-Merriam-Webster, Oxford University Press, and Houghton Mifflin Harcourt, among others-operate at the intersection of publishing, technology, and data licensing. Traditional revenue streams based on print sales have steadily declined, but they have been replaced and often surpassed by digital income from subscriptions, institutional licenses, and API access agreements.

Corporate clients license dictionary databases to power spell-checkers, search algorithms, customer-support chatbots, and translation tools. Educational institutions purchase campus-wide access to premium dictionary platforms, bundling them with other e-resources in deals negotiated through consortia and library networks. App stores host paid and freemium dictionary applications that generate recurring revenue, particularly in markets where English learning is a priority, such as Japan, South Korea, Thailand, and Malaysia. Organizations like the Association of American Publishers track these digital transitions as part of broader trends in the knowledge economy, where data and subscription models increasingly dominate.

For the financial and corporate readership of usa-update.com, the dictionary sector offers a compelling case study in legacy-business transformation. Companies that once competed on the basis of print quality and editorial reputation now differentiate themselves through API reliability, integration partnerships, and analytics offerings. Some publishers experiment with tiered services, providing basic definitions for free while charging for advanced features such as historical corpora, specialized technical vocabularies, or integration with writing-assistance tools. Others explore partnerships with AI developers, contributing curated training data to improve language models while seeking to protect intellectual property and brand visibility.

The global dimension of the market is equally important. English-language dictionaries produced in the United States and the United Kingdom hold substantial market share in Europe, South America, Africa, and Oceania, with particularly strong uptake in countries such as India, Brazil, South Africa, Australia, and New Zealand. Demand is driven not only by education but also by international trade, tourism, and digital services. For readers interested in international commerce and travel, this underscores how lexicographic products function as exportable intellectual goods that reinforce the global footprint of American and British cultural influence.

Trust, Misinformation, and the Role of Dictionaries in the AI Age

The 2020s have been marked by intense concern over misinformation, disinformation, and the erosion of trust in institutions. Social media platforms, messaging apps, and generative AI systems can spread inaccuracies at unprecedented scale and speed, blurring the line between credible information and persuasive fabrication. In this environment, dictionaries have emerged as relatively trusted anchors-sources that many users still regard as neutral and evidence-based.

Maintaining that trust, however, is not automatic. Lexicographers must navigate politically charged terrain when updating entries related to public health, climate science, or social identity, often facing criticism from multiple directions. To preserve credibility, major publishers rely on transparent editorial policies, expert panels, and rigorous citation practices. Organizations such as the American Dialect Society and the Linguistic Society of America contribute scholarly perspectives that inform decisions about when and how to recognize emerging usage.

Digital manipulation presents another challenge. Coordinated campaigns can attempt to influence dictionary traffic statistics or flood online discourse with novel or distorted meanings. To counter this, dictionary publishers invest in analytics and moderation tools that distinguish genuine organic usage from artificial amplification, often in collaboration with cybersecurity and data-science teams. This work aligns with broader efforts across the information ecosystem to safeguard integrity, from news organizations to academic publishers. For readers of usa-update.com who track news and technology policy, it is increasingly clear that lexicographic institutions form part of the front line in the defense of factual, shared understanding.

Generative AI adds another layer of complexity. Large language models trained on vast text corpora implicitly absorb dictionary content, style, and structure, even when not directly licensed. At the same time, these models can generate definitions or usage examples that appear authoritative but may be subtly inaccurate or outdated. Some dictionary publishers are responding by forming partnerships with AI companies to provide verified definitions and usage data, ensuring that AI outputs align with established standards. Others are exploring ways to watermark or otherwise identify high-quality lexicographic content so that search engines and AI tools can prioritize it. The outcome of these experiments will shape how future generations access and trust definitions in an environment where the boundary between human- and machine-authored text continues to blur.

Entertainment, Lifestyle, and the Cultural Appeal of Words

While dictionaries are often associated with formal education and professional writing, they also occupy a surprising place in entertainment and lifestyle culture. Word games, vocabulary challenges, and spelling competitions have gained renewed popularity, boosted by digital platforms and streaming media. The Scripps National Spelling Bee, for example, attracts substantial viewership and coverage from outlets like ESPN, turning lexicographic mastery into a national spectacle that showcases the dedication of young competitors and the richness of English.

Digital dictionary platforms themselves have embraced gamification. Many now offer quizzes, streak-based learning systems, and shareable word features that appeal to casual users as well as serious language enthusiasts. The "Word of the Day" emails that once served primarily as educational tools now double as lifestyle content, shared on social networks and integrated into daily routines much like horoscopes or fitness reminders. For readers following lifestyle coverage on usa-update.com, this demonstrates how language learning has been reframed as a form of personal development and leisure rather than a purely academic obligation.

Streaming services and film studios have also discovered the narrative potential of lexicography. Documentaries and dramatizations explore the history of English, the evolution of slang, and the lives of influential lexicographers, bringing what was once a niche scholarly field into mainstream cultural conversation. These productions often draw on archival materials from institutions like the Library of Congress or the Smithsonian Institution, highlighting the deep historical roots of reference publishing in the United States. The result is a virtuous cycle in which public curiosity about words drives traffic to dictionary platforms, which in turn provide data and expertise that inform future creative projects.

Globalization, Multilingualism, and Cross-Cultural Communication

As globalization continues to knit together economies across North America, Europe, Asia, Africa, and South America, dictionaries have taken on an increasingly international function. American English dictionaries are widely used in educational systems from Mexico to South Korea, often alongside bilingual resources that facilitate language acquisition and cross-cultural understanding. The rise of digital trade and remote work has only intensified the need for clear, standardized English in sectors such as software development, customer support, and professional services.

At the same time, there is growing recognition that English does not exist in isolation. Multilingual dictionaries and translation tools serve as bridges between English and languages such as Spanish, Mandarin, Arabic, and Hindi. Platforms like WordReference and Linguee blend human-curated and crowd-sourced content, while AI-driven systems such as DeepL and Google Translate increasingly rely on lexicographic data to refine their models and reduce errors. For global businesses, accurate translation is not merely a convenience; it is a risk-management necessity that affects contracts, marketing, and customer satisfaction across diverse markets.

For readers of usa-update.com who monitor international trends and cross-border investment, it is important to understand that dictionaries play a subtle but critical role in enabling this global exchange. They provide the semantic scaffolding that allows engineers in Germany to collaborate with colleagues in California, regulators in Brussels to coordinate with counterparts in Washington, D.C., and tourists from Japan to navigate New York or Los Angeles with confidence. In this sense, dictionaries function as both cultural artifacts and practical tools of globalization, supporting mobility, trade, and diplomacy.

Energy, Sustainability, and Emerging Economic Narratives

The vocabulary of energy and sustainability has expanded rapidly in the last decade, reflecting shifts in policy, technology, and investor expectations. Terms such as "renewable portfolio standard," "energy transition," "scope 3 emissions," and "just transition" now appear in corporate reports, government strategies, and media coverage worldwide. Dictionaries have had to keep pace, coordinating with subject-matter experts to ensure that entries accurately capture both technical nuances and policy implications. Organizations like the International Energy Agency and the U.S. Energy Information Administration provide reference frameworks that lexicographers draw upon when defining emerging concepts.

For the energy and climate-conscious readership of usa-update.com, which may also consult specialized coverage on energy and economy, the evolution of this vocabulary is more than semantic. It shapes how investors evaluate environmental, social, and governance (ESG) risks, how regulators design disclosure requirements, and how consumers assess claims about sustainability. When a dictionary codifies a term like "greenwashing," it crystallizes public awareness of deceptive practices and can influence legal arguments, shareholder activism, and brand strategies. Lexicographic choices therefore contribute to the broader economic narrative around decarbonization, resilience, and sustainable growth.

Looking Ahead: Dictionaries Toward 2030

As 2030 approaches, dictionaries are poised to continue their transformation from static references into interactive, AI-enhanced platforms. Voice assistants embedded in smartphones, cars, and smart-home devices already offer on-demand definitions and translations, often powered by dictionary data behind the scenes. Advances in augmented reality may soon enable users to point a device at an unfamiliar word in the physical environment-on signage, packaging, or documents-and receive instant, context-aware explanations.

Artificial intelligence will play a dual role in this future. On one hand, AI tools will help lexicographers process enormous quantities of text and speech from sources as varied as academic journals, social media, film subtitles, and business communications, allowing for earlier detection of emerging usage patterns and regional variations. On the other hand, human expertise will remain indispensable for interpreting nuance, resolving ambiguity, and ensuring that definitions are inclusive, culturally sensitive, and ethically responsible. Institutions such as the Modern Language Association and university linguistics departments will continue to collaborate with publishers to balance computational efficiency with scholarly rigor.

For usa-update.com and its readers, the trajectory of dictionaries offers a microcosm of broader digital transformation. An industry that once seemed mature and static has reinvented itself as a provider of critical infrastructure for education, commerce, governance, and entertainment. Its success depends not only on technological innovation but also on the preservation of trust-a resource that is increasingly scarce yet essential for functioning markets and democratic societies.

Why Dictionaries Still Matter in 2026

In a world saturated with content, algorithms, and instant answers, it might be tempting to assume that dictionaries have been overshadowed by search engines and AI assistants. Yet in 2026, their influence is both pervasive and foundational. They shape how contracts are interpreted, how students learn, how journalists write, how regulators draft rules, and how global businesses negotiate across cultures. They provide shared reference points in debates that might otherwise devolve into semantic confusion.

For the community that turns to usa-update.com for insight into business, technology, finance, international, and news, dictionaries occupy a unique intersection of experience, expertise, authoritativeness, and trustworthiness. They are products of painstaking human labor, enhanced by cutting-edge data science, and validated by their consistent use in courts, classrooms, and boardrooms.

Ultimately, dictionaries remain cultural compasses for the United States and for a global audience that increasingly communicates in English. They help individuals and institutions navigate the shifting terrain of meaning in an age defined by rapid change, digital complexity, and high stakes. As long as words retain the power to inform markets, influence elections, shape regulations, and connect people across continents, the work of American lexicography will continue to matter-quietly but profoundly-to the future that usa-update.com chronicles every day.