Wall Street And The World: How The US Stock Market Compares With Global Indices

A New Phase For Markets In 2026

By early 2026, the relationship between the United States stock market and major global indices has entered a more mature and complex phase. The years since the pandemic, the inflation shock of the early 2020s, and the rapid commercialization of artificial intelligence have reshaped how investors in North America, Europe, Asia, and emerging economies think about risk, growth, and diversification. For readers of usa-update.com, the core question is no longer whether Wall Street is "winning" in a narrow performance sense, but how its leadership fits into an increasingly multipolar financial system, and what that means for American households, businesses, and policymakers.

The US still anchors global capital flows, yet the rise of powerful regional exchanges in Europe and Asia, the deepening of markets in countries such as India and Brazil, and the expansion of alternative and digital assets mean that the old assumption of US exceptionalism is being tested in more subtle ways. In this environment, understanding the comparative strengths of the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average relative to benchmarks such as the MSCI World, MSCI Emerging Markets, Euro Stoxx 50, Nikkei 225, and FTSE 100 is essential for any investor or executive who wants to manage risk responsibly and capture opportunity.

For a US-based audience whose interests span the economy, employment, regulation, technology, and international affairs, this comparative lens is not theoretical. It touches retirement accounts, corporate funding costs, job creation, and even the price of travel and imported goods. The editorial mission of usa-update.com is to connect these global developments to everyday decision-making in the United States, and that mission has rarely been more relevant than in 2026.

The Enduring Power Of Wall Street

The New York Stock Exchange (NYSE) and Nasdaq remain the world's most important equity markets by market capitalization, liquidity, and breadth. Iconic firms such as Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla still sit at the center of global equity portfolios, and their quarterly earnings calls are watched as closely in Frankfurt, Tokyo, and Singapore as they are in New York. The scale of these companies, many of which now exceed the GDP of mid-sized countries, keeps the US at the heart of global risk sentiment.

This enduring leadership rests on several pillars. First is the depth of the US corporate sector and its ability to commercialize innovation faster than most peers. The country's ecosystem of venture capital, research universities, and entrepreneurial culture continues to channel ideas into listed companies at a pace that few regions can match. Second is the institutional strength of US capital markets, including disclosure standards, legal protections for investors, and the sophistication of intermediaries such as JPMorgan Chase, Goldman Sachs, and Morgan Stanley. These factors make Wall Street a preferred destination for global capital seeking transparency and liquidity.

At the same time, the last decade has seen a quiet but persistent rebalancing. Major foreign exchanges such as London's FTSE 100, Germany's DAX 40, Japan's Nikkei 225, and China's Shanghai Composite have become more influential in shaping global sentiment, particularly during periods when local policy or sector trends diverge from the US. Investors who once treated non-US markets as peripheral now recognize that developments in Europe's energy transition, Japan's corporate reforms, or China's technology regulation can move portfolios worldwide. Readers interested in how these shifts intersect with broader macro trends can follow dedicated coverage in the economy section of usa-update.com.

The Federal Reserve And Global Monetary Cross-Currents

No institution exerts more influence on global financial conditions than the Federal Reserve. Its policy path from aggressive rate hikes in the early 2020s to a more calibrated stance in mid-decade has shaped everything from mortgage rates in the United States to capital flows into emerging markets. When the Fed tightens policy, the US dollar typically strengthens, funding costs for dollar borrowers abroad rise, and risk assets often reprice lower. When it signals easing or a pause, global liquidity expands, and appetite for equities and higher-yielding assets usually recovers.

In 2026, the Fed's challenge remains balancing inflation management with the need to sustain growth and financial stability. Its decisions are closely watched by other central banks, including the European Central Bank (ECB), the Bank of England, the Bank of Japan, and the Bank of Canada, whose own policy choices are constrained by exchange rate dynamics and capital flows that still revolve around the dollar. Analysts who monitor global monetary policy and liquidity conditions observe that divergences in central bank strategies can create pockets of opportunity, as well as stress, across different regions and asset classes.

For US investors and businesses, this global interplay is not an academic matter. Dollar strength affects the competitiveness of American exports, the translation of overseas earnings for multinationals, and the relative attractiveness of US versus foreign equities. A stronger dollar often coincides with outperformance of US assets in local terms but can weigh on emerging markets that rely on external funding, while a softer dollar tends to favor non-US indices and commodities. In this context, the S&P 500 does not move in isolation; it is part of a worldwide repricing mechanism that links Washington, Brussels, Tokyo, Beijing, and beyond.

Readers seeking to understand how these monetary dynamics influence corporate financing, household borrowing, and asset prices will find regular analysis in the finance coverage on usa-update.com.

Comparative Performance: US Versus Global Benchmarks

By 2026, the performance gap between US equities and global peers has narrowed compared with the extraordinary outperformance of American stocks in the 2010s and early 2020s. The US market still commands a premium valuation, largely due to its concentration of high-growth technology and healthcare leaders, but investors have increasingly reallocated capital to Europe, Asia, and selected emerging markets in search of lower valuations and differentiated sector exposures.

Indices such as the MSCI World Index, which tracks developed markets, and the MSCI Emerging Markets Index, which includes countries like India, Brazil, and South Africa, have benefited from this shift. Europe's Euro Stoxx 50 has found support from large-scale public and private investment in green infrastructure and digitalization, while Japan's Nikkei 225 has been buoyed by corporate governance reforms that encourage higher shareholder returns through buybacks and dividends. Detailed statistics on these trends are frequently summarized by organizations such as the OECD and World Bank, which track global capital flows and economic growth patterns.

From a US perspective, the key question is how to blend domestic and international exposure in a way that maximizes long-term risk-adjusted returns. While the Nasdaq Composite and S&P 500 remain core holdings for many American retirement accounts, the case for adding non-US equities has strengthened as valuation spreads widened and sector leadership diversified. For readers of usa-update.com, this is directly relevant to 401(k) allocation decisions, corporate treasury strategies, and the design of institutional portfolios.

- Largest market capitalization globally with NYSE and Nasdaq leadership

- Technology dominance through Apple, Microsoft, Nvidia, Amazon, Meta

- Deep venture capital ecosystem and innovation infrastructure

- Strong investor protections and regulatory frameworks

- S&P 500: Broad market benchmark of 500 leading companies

- Nasdaq Composite: Technology-heavy index with growth focus

- Dow Jones Industrial Average: 30 blue-chip companies

- Leadership in ESG integration and sustainable finance

- Strong industrial base in automotive and manufacturing

- Advanced renewable energy and green infrastructure

- Robust regulatory frameworks for data privacy and competition

- Euro Stoxx 50: Top 50 companies across Eurozone countries

- FTSE 100: London's benchmark of leading UK companies

- DAX 40: Germany's premier stock market index

- Semiconductor manufacturing dominance (TSMC, Samsung)

- Advanced robotics and industrial automation

- Rapid digital platform growth and fintech innovation

- Corporate governance reforms driving shareholder returns

- Nikkei 225: Japan's premier stock market benchmark

- Shanghai Composite: China's primary stock index

- Hang Seng: Hong Kong's leading market indicator

- Fast-growing consumer markets and demographics

- Natural resource wealth in energy and minerals

- Lower valuations offering diversification opportunities

- Digital transformation and mobile-first economies

- MSCI Emerging Markets: Broad benchmark including 24+ countries

- India: Rapidly growing economy with expanding tech sector

- Brazil: Resource-rich with agricultural and energy strength

- South Africa: Gateway to African markets and mining

- US maintains leadership but faces multipolar competition

- Asian markets gaining ground in semiconductors and manufacturing

- Europe leading ESG integration and sustainability

- Emerging markets offering growth and diversification

- Technology sector remains US strength but globalizing

Geopolitics, Security, And Market Fragmentation

Geopolitical risk is now a structural feature of the investment landscape rather than an occasional shock. Trade tensions between the United States and China, Russia's ongoing confrontation with Western powers, and regional disputes in areas such as the South China Sea and the Middle East have contributed to what many analysts describe as a "fragmenting globalization." This has profound implications for both US and global stock markets.

When Washington announces new export controls on advanced semiconductors, or when Beijing tightens data regulations, technology stocks from Silicon Valley to Shenzhen can move sharply. Energy markets remain sensitive to supply disruptions and sanctions, which in turn affect the share prices of companies in the S&P 500 Energy Index, the FTSE 100, and resource-heavy indices in countries like Brazil and South Africa. Institutions such as the Council on Foreign Relations and Brookings Institution regularly analyze how these geopolitical developments feed into economic and market outcomes.

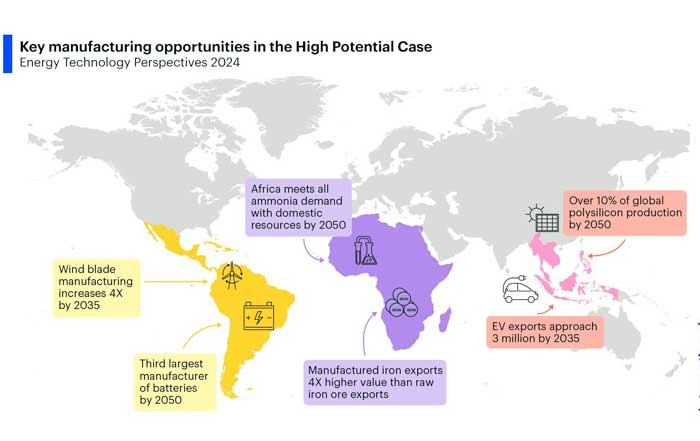

For US investors, one of the most important implications of this environment is the need to think in terms of regional blocs and supply-chain ecosystems. North America, supported by the US-Mexico-Canada Agreement (USMCA), is becoming more self-contained in certain strategic sectors, particularly autos, batteries, and critical minerals. Europe is accelerating its energy transition to reduce dependency on geopolitical flashpoints, while Asian economies are re-wiring trade routes to balance security concerns with growth ambitions. Coverage in the international section of usa-update.com frequently highlights how these shifts alter the risk and opportunity set for US businesses with global footprints.

Technology Leadership And The AI Super-Cycle

The technology sector remains the defining strength of the US equity market. The AI super-cycle that accelerated after 2023 continues to shape valuations and capital expenditure plans in 2026. Companies such as Nvidia, Microsoft, Alphabet, Amazon Web Services, and Meta dominate cloud infrastructure, AI chips, data platforms, and consumer applications. Their scale and profitability give the Nasdaq Composite an outsized influence on global benchmarks.

However, the narrative of US tech supremacy is no longer uncontested. Asian champions, including Samsung Electronics, TSMC, and leading Chinese platform and hardware firms, have become indispensable in the semiconductor supply chain and in specific niches such as 5G infrastructure, electric vehicles, and industrial automation. Japan has reasserted its role in robotics and advanced manufacturing, while Europe focuses on regulatory leadership in data privacy, digital competition, and green technology. The World Economic Forum and MIT Technology Review frequently explore how these regional strengths interact in a globally integrated innovation ecosystem.

For investors, the consequence is that technology exposure can no longer be approximated simply by owning US mega-caps. Sector diversification now requires attention to hardware-intensive and manufacturing-oriented innovation in Asia, regulatory-driven opportunities in Europe, and fast-growing digital platforms in emerging markets. Readers who follow technology updates on usa-update.com will recognize that this global mosaic influences everything from venture capital flows in California to job creation in Texas, Ohio, and North Carolina.

ESG, Climate, And The New Drivers Of Capital Allocation

Environmental, Social, and Governance (ESG) considerations have moved from the periphery to the mainstream of investment analysis. While the intensity of the ESG debate in the United States has fluctuated, particularly in the political arena, large asset managers, insurers, and pension funds continue to integrate climate and sustainability risks into their models, driven by fiduciary duty and regulatory expectations. The US Securities and Exchange Commission (SEC) has advanced climate-related disclosure rules, and global frameworks such as those promoted by the Task Force on Climate-related Financial Disclosures and the International Sustainability Standards Board increasingly shape corporate reporting.

Europe remains at the forefront of ESG integration, with the EU taxonomy for sustainable activities and other regulatory initiatives providing detailed guidance on what constitutes green or sustainable investment. Nordic countries, including Sweden, Norway, and Denmark, have been pioneers in green bonds and low-carbon strategies, and their exchanges often serve as test beds for sustainability-linked financial innovation. In Asia, Singapore and Japan have built significant green finance hubs, while China continues to scale production in solar, wind, and battery technologies, making climate-related sectors central to its equity markets.

For US companies listed on the NYSE and Nasdaq, this global ESG landscape creates both risk and opportunity. Firms that can demonstrate credible transition plans, energy efficiency, and responsible supply-chain management may benefit from lower capital costs and broader investor bases, while laggards face reputational and regulatory headwinds. The business section of usa-update.com regularly examines how American corporates are adjusting strategies in response to these pressures, and how investors can align portfolios with long-term sustainability trends without sacrificing returns.

Sectoral Contrasts Across Regions

Understanding the relative strengths of different sectors in the US and abroad is central to building resilient portfolios and making informed strategic decisions.

In technology and communication services, the United States remains pre-eminent, with Apple, Microsoft, Nvidia, Meta, Amazon, and Netflix defining many of the platforms and devices that shape global consumer and enterprise behavior. In healthcare and biotechnology, companies such as Pfizer, Johnson & Johnson, Eli Lilly, and Moderna continue to lead in drug discovery, vaccines, and medical devices, although European firms like Roche, Novartis, and Sanofi and Japanese groups such as Takeda provide formidable competition and diversification.

Energy presents a more balanced picture. US oil and gas producers, including ExxonMobil and Chevron, remain major players in global supply, while US utilities and renewables leaders like NextEra Energy have become symbols of the domestic energy transition. Europe's energy sector, represented in indices such as the FTSE 100 and DAX 40, has moved aggressively into offshore wind, grid modernization, and hydrogen, with companies like Ørsted and Siemens Energy at the forefront. Emerging markets from Brazil to South Africa leverage natural resource endowments to attract foreign capital into both fossil and clean energy projects. For readers who follow energy developments on usa-update.com, these sectoral contrasts highlight how climate policy, technology, and geopolitics intersect.

Financial services, meanwhile, remain a pillar of US influence, with JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo playing central roles in global credit intermediation, asset management, and transaction banking. Yet European banks, after years of restructuring, have stabilized, and Asian financial centers such as Singapore and Hong Kong continue to compete for regional leadership in wealth management and capital markets. These dynamics affect not only investors but also employment patterns in New York, Charlotte, Toronto, London, Frankfurt, and Singapore, a theme explored in the employment insights on usa-update.com.

The Rise Of Alternatives And Digital Assets

Beyond traditional equities and bonds, investors in 2026 have a significantly broader toolkit. Private equity, private credit, infrastructure, and real assets have grown as institutional investors seek yield and diversification in a world where interest rates, while higher than the ultra-low era of the 2010s, remain moderate in real terms. Large US and global managers have raised record amounts of capital for unlisted strategies, and many of the most innovative technology and healthcare companies now spend years in private markets before considering an IPO.

Digital assets, including cryptocurrencies and tokenized securities, have matured from a speculative fringe into a more regulated, though still volatile, asset class. Jurisdictions such as Switzerland and Singapore have positioned themselves as hubs for blockchain innovation, while US regulators, including the SEC and Commodity Futures Trading Commission (CFTC), have sought to clarify rules around custody, disclosure, and market structure. Institutions such as the Bank for International Settlements and International Monetary Fund actively study the systemic implications of digital finance and central bank digital currencies.

For US investors, the key challenge is integrating these alternative and digital exposures into a coherent portfolio anchored in traditional markets like the S&P 500 and MSCI World. Coverage in the finance section of usa-update.com often emphasizes that while alternatives can enhance returns and diversification, they also introduce complexity, illiquidity, and regulatory uncertainty that must be carefully managed.

Labor Markets, Jobs, And The Real-Economy Link

The performance of stock markets is closely tied to labor markets, and this link has become more visible as technology and globalization reshape employment. The boom in US technology and advanced manufacturing has created high-skilled jobs in software engineering, data science, chip fabrication, and clean-energy infrastructure, even as automation and offshoring have pressured some middle-income roles in traditional manufacturing and services.

For American workers, the health of the Nasdaq and S&P 500 is not just an abstract indicator; it influences hiring plans, wage growth, and corporate training budgets. At the same time, the rise of global competitors means that jobs in sectors such as automotive, electronics, and financial services are increasingly distributed across North America, Europe, and Asia. Organizations such as the US Bureau of Labor Statistics and International Labour Organization track how these trends affect employment, wages, and skills requirements.

Readers who follow jobs coverage on usa-update.com know that the interplay between Wall Street and global indices also shapes career prospects indirectly. When US markets outperform, domestic firms may invest more aggressively in research, expansion, and hiring. When foreign markets gain ground, American multinationals may shift more operations abroad or seek talent in lower-cost regions, even as they maintain strategic leadership at home. The challenge for US policymakers is to ensure that education, training, and labor regulation keep pace with these shifts, preserving competitiveness while supporting workers through transitions.

Travel, Culture, And Global Business Expansion

Stock market dynamics are also reflected in travel, cultural exports, and cross-border business expansion. As international travel has normalized post-pandemic, airlines, hotel chains, and tourism operators listed on the Dow Jones, FTSE 100, and major Asian indices have seen demand recover, although profitability remains sensitive to fuel prices, labor costs, and regulatory changes. The strength or weakness of the US dollar relative to the euro, yen, and other currencies affects how far American travelers' budgets go in destinations from Europe to Asia and Africa.

Cultural industries, including film, streaming, gaming, and music, illustrate another dimension of the US-global market relationship. Companies like Disney, Netflix, Warner Bros. Discovery, and Paramount Global compete with European, Korean, Japanese, and Indian content producers for global audiences. Their success or failure in international markets feeds back into stock performance and strategic priorities, such as localization of content and partnerships with regional platforms. Publications such as Variety and The Hollywood Reporter regularly document how these competitive dynamics evolve.

For readers of usa-update.com, the intersection of travel, culture, and business is more than lifestyle content; it is a lens on how American firms monetize their brands abroad and how shifts in consumer preferences in Europe, Asia, and Latin America influence US corporate earnings. The travel section and entertainment updates on the site frequently connect these themes back to broader economic and market narratives.

Regulation, Trust, And Market Integrity

Trust is the foundation of any financial system, and in 2026, questions of regulation and market integrity are central to debates about the relative attractiveness of US versus global markets. The United States retains a strong reputation for investor protection, disclosure standards, and enforcement, supported by institutions such as the SEC, Financial Industry Regulatory Authority (FINRA), and federal courts. However, the rapid emergence of new technologies, from algorithmic trading to decentralized finance, has tested the agility of regulators and raised concerns about fairness, transparency, and systemic risk.

Other jurisdictions have taken varied approaches. The European Union has implemented far-reaching rules on market structure, data privacy, and digital competition, while the United Kingdom, post-Brexit, has sought to balance high standards with flexibility to maintain London's status as a global financial hub. Asian regulators in Singapore, Hong Kong, and Tokyo have positioned their markets as well-regulated but innovation-friendly, particularly in fintech and digital assets. Institutions such as the IOSCO and Financial Stability Board coordinate international standards to reduce regulatory arbitrage and enhance resilience.

For US investors and companies, staying ahead of these regulatory developments is crucial. New rules on climate disclosure, data security, AI usage, and cross-border listings can affect compliance costs, access to foreign markets, and the competitive landscape. The regulation section of usa-update.com is designed to help executives, legal teams, and investors anticipate these changes and adapt strategies accordingly, reinforcing the site's commitment to experience-driven, authoritative analysis.

What It Means For American Households And Consumers

The interplay between the US stock market and global indices ultimately flows through to American households. Retirement savings in 401(k)s and IRAs are often heavily weighted toward US equities, particularly through index funds tracking the S&P 500 and Nasdaq. The performance of these benchmarks relative to global peers influences the long-term purchasing power of retirees, the ability of families to fund education, and the confidence with which consumers spend on housing, vehicles, and travel.

At the same time, the globalization of corporate supply chains and revenue streams means that when international markets perform well, US multinationals can benefit through higher foreign sales, even if domestic conditions are more subdued. Conversely, when geopolitical tensions or regional recessions hit Europe, Asia, or Latin America, those shocks can reverberate through the earnings of companies held in US index funds. Organizations such as the Federal Reserve Board and US Census Bureau provide regular data on household wealth, consumption, and international trade that illustrate these linkages.

For consumers, exchange rate movements and global commodity prices affect everything from gasoline and electricity bills to the cost of imported electronics and food. The consumer insights section of usa-update.com regularly explains how shifts in global indices and currencies show up in everyday prices, supporting more informed decisions by households across the United States.

Looking Toward 2030: A Multipolar Financial Future

Looking ahead to the end of this decade, most credible scenarios point toward a more multipolar financial system in which the United States remains the single most important market but no longer enjoys the same degree of unchallenged dominance it once held. Asia's share of global GDP and market capitalization is likely to continue rising, driven by countries such as China, India, South Korea, and members of ASEAN. Europe's success will depend on the execution of its green and digital strategies and its ability to manage demographic headwinds. North America, including Canada and Mexico, may benefit from near-shoring and regional integration that reinforce its role as a manufacturing and innovation hub.

For US investors, businesses, and policymakers, the implication is clear: success will require a dual mindset that combines confidence in domestic strengths with a nuanced appreciation of global dynamics. Diversification across regions, sectors, and asset classes will be essential to navigate volatility and capture growth. Continuous monitoring of international developments-economic, political, technological, and regulatory-will be indispensable for protecting portfolios and strategic plans.

The editorial approach of usa-update.com is built around this reality. By integrating coverage across business, finance, international affairs, consumer trends, and news, the platform aims to provide readers with a coherent, trustworthy, and experience-based perspective on how Wall Street interacts with the rest of the world. As 2026 unfolds and the path to 2030 becomes clearer, that integrated view will remain vital for anyone seeking to understand not only where markets stand today, but where they are heading in the decade ahead.