Presidential Power and the U.S. Economy in 2026: Influence, Limits, and Global Impact

The modern presidency sits at the intersection of politics, markets, and public confidence, and nowhere is this more visible than in the way each President of the United States is judged by the strength or weakness of the economy. For readers of usa-update.com, whose interests range from economy and finance to business, jobs, international affairs, and everyday consumer realities, understanding what presidents can and cannot do in shaping economic outcomes has become essential to interpreting headlines, investment decisions, and long-term strategic planning in 2026.

Across decades, presidents have been credited with booms and blamed for recessions, praised for innovation and condemned for crises, yet the true extent of presidential economic power is more nuanced. It is grounded in constitutional authority, amplified through appointments and regulatory decisions, constrained by Congress and the Federal Reserve, and constantly tested by global shocks that originate far beyond Washington. In an era defined by post-pandemic adjustment, inflation management, digital transformation, geopolitical rivalry, and climate transition, the presidency remains a powerful but not omnipotent economic institution whose influence unfolds over years, not news cycles.

This article examines the foundations, mechanisms, and limits of presidential economic power as they stand in 2026, drawing on historical experience while focusing on the implications for businesses, investors, workers, and consumers in the United States, North America, and key global markets across Europe, Asia, and beyond.

Constitutional Foundations and Structural Constraints

The Presidency as an Economic Actor

The U.S. Constitution does not explicitly define the president as an economic policymaker, yet the office has evolved into one of the most consequential economic actors in the world. The president proposes budgets, signs or vetoes legislation, issues executive orders, negotiates trade agreements, and appoints the leadership of institutions that govern money, credit, and regulation. These formal powers are reinforced by the informal authority to set the national agenda, frame economic narratives, and signal direction to markets and foreign governments.

At the same time, the presidency is embedded in a system of checks and balances designed to prevent unilateral control. Fiscal policy ultimately depends on Congress, which holds the power of the purse and must authorize spending and taxation. Monetary policy is delegated to the Federal Reserve, an independent central bank whose decisions on interest rates and balance sheet operations shape inflation, credit conditions, and financial stability. Regulatory agencies, courts, state governments, and international agreements add further layers of constraint that limit the speed and scope of presidential initiatives.

For business leaders and investors following developments through usa-update.com/economy.html and usa-update.com/business.html, this means that presidential promises, campaign platforms, and policy speeches must always be interpreted through the lens of institutional reality: the president can steer, but cannot command, the direction of the $27 trillion-plus U.S. economy or the broader global system that depends on it.

Budget Power, Legislation, and the Art of Negotiation

Each year, the president submits a budget proposal that outlines spending priorities, tax policies, and deficit projections. This proposal, published and analyzed by the Office of Management and Budget (OMB) and reviewed by the Congressional Budget Office (CBO), serves as a blueprint rather than a binding plan. Legislators in the House and Senate reshape the budget through appropriations and tax bills, often reflecting partisan divisions, regional interests, and lobbying by industries and advocacy groups.

The president's real leverage lies in agenda-setting and negotiation. By framing certain initiatives-such as infrastructure modernization, tax reform, defense spending, or social programs-as national imperatives, presidents can mobilize public opinion and pressure Congress to act. The veto power further strengthens the executive hand, as the credible threat to reject legislation can force compromises. Over time, these negotiations can significantly alter the composition of federal spending, the structure of the tax code, and the balance between consumption and investment in the economy.

For those tracking fiscal trends and their implications for borrowing costs, corporate planning, and household finances, resources such as the U.S. Department of the Treasury and the Bureau of Economic Analysis provide essential data and context, while coverage at usa-update.com/finance.html helps interpret how presidential budgets translate into real-world impacts.

Appointments and the Architecture of Economic Governance

Perhaps the most enduring economic influence of any presidency lies in appointments. The president nominates the Chair of the Federal Reserve and members of the Board of Governors, the Treasury Secretary, the Director of the National Economic Council, and the heads of critical regulatory agencies such as the Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), and the Federal Trade Commission (FTC). With Senate confirmation, these appointees shape monetary policy, financial regulation, corporate oversight, consumer protection, and trade enforcement for years, often well beyond the president's own term.

The Federal Reserve, whose mandate includes price stability and maximum employment, is particularly central. Its decisions on interest rates, quantitative tightening or easing, and emergency lending facilities have direct consequences for mortgage rates, corporate borrowing, asset valuations, and currency markets. Business leaders seeking to understand how presidential appointments influence the Fed's direction can consult the central bank's official communications at federalreserve.gov, alongside analysis from institutions such as the Brookings Institution and Peterson Institute for International Economics.

For readers of usa-update.com/news.html, the key insight is that even when day-to-day politics appear volatile, the institutional continuity provided by these appointees often stabilizes expectations and guides the long-term trajectory of regulatory and monetary frameworks.

Historical Evidence: How Presidents Have Shaped Economic Trajectories

Franklin D. Roosevelt: Crisis Management and Structural Reform

During the Great Depression, Franklin D. Roosevelt demonstrated how presidential leadership, when aligned with congressional support and public demand for action, can fundamentally reshape the economic order. The New Deal combined emergency relief with long-term institutional reform: programs such as the Civilian Conservation Corps (CCC) and Works Progress Administration (WPA) created jobs and injected purchasing power into a collapsed economy, while banking reforms, including the creation of the Federal Deposit Insurance Corporation (FDIC), restored confidence in the financial system.

Perhaps most enduring was the establishment of Social Security, which introduced a national social insurance framework that continues to underpin retirement income and disability support. Roosevelt's economic legacy illustrates that in times of severe crisis, the presidency can leverage extraordinary political capital to expand the federal role in ways that permanently alter the relationship between state, market, and citizen. Historical analysis from sources such as the Franklin D. Roosevelt Presidential Library and Museum and economic research from the National Bureau of Economic Research underline the depth of this transformation.

Ronald Reagan: Deregulation, Tax Cuts, and Market Liberalization

In the 1980s, Ronald Reagan brought a sharply different philosophy to the White House, emphasizing smaller government, lower taxes, and deregulation as pathways to growth. The Economic Recovery Tax Act of 1981 cut marginal income tax rates, while subsequent reforms broadened the tax base and altered corporate incentives. Deregulatory efforts in sectors such as finance, transportation, and telecommunications aimed to increase competition and reduce compliance burdens.

Supporters argue that these policies unleashed entrepreneurial energy, helped tame inflation in partnership with the Federal Reserve under Paul Volcker, and set the stage for a long expansion. Critics counter that the benefits accrued disproportionately to higher-income households and that financial deregulation contributed to later instability. Either way, Reagan's presidency shows how a clear ideological vision, combined with legislative success, can redirect the policy environment for decades. For deeper study, business audiences often reference work by the Hoover Institution and the American Enterprise Institute when evaluating the legacy of Reaganomics.

Bill Clinton: Globalization, Technology, and Fiscal Discipline

The 1990s under Bill Clinton coincided with rapid technological innovation, the rise of the internet, and accelerated globalization. Clinton's administration pursued trade liberalization through agreements such as the North American Free Trade Agreement (NAFTA) and support for the creation of the World Trade Organization (WTO), seeking to integrate the U.S. more deeply into global supply chains and export markets. At the same time, a focus on deficit reduction, combined with strong growth, led to budget surpluses late in his tenure.

This period is often cited as an example of how presidential leadership can align with structural trends-such as the digital revolution-to reinforce confidence, attract investment, and support job creation, even as it also generated dislocation in manufacturing regions and intensified debates about offshoring and wage inequality. Business and policy communities continue to analyze this era through resources like the WTO and the World Bank, while usa-update.com/international.html regularly explores how trade policy legacies still shape global competition in 2026.

Barack Obama: Recovery from Financial Crisis

When Barack Obama took office in 2009, the United States was facing its worst financial crisis since the 1930s. The administration's response included the American Recovery and Reinvestment Act, measures to stabilize the banking system, and support for the auto industry. In parallel, the Dodd-Frank Wall Street Reform and Consumer Protection Act overhauled financial regulation, introducing stricter capital requirements, enhanced oversight of derivatives, and the creation of the Consumer Financial Protection Bureau (CFPB).

These actions highlighted the dual nature of presidential economic leadership: emergency stabilization to prevent collapse, and institutional reform to reduce future systemic risk. While debates over the appropriate scale of stimulus and regulation continue, data from the International Monetary Fund and Bank for International Settlements suggest that the U.S. recovery outpaced many advanced economies, reinforcing perceptions of the presidency as a central crisis-management institution.

Donald Trump: Protectionism, Tax Reform, and Policy Volatility

The presidency of Donald Trump marked a departure from the bipartisan consensus on free trade that had characterized previous decades. Through tariffs on imports from China, steel and aluminum levies, and renegotiation of NAFTA into the United States-Mexico-Canada Agreement (USMCA), Trump pursued a more protectionist and transactional approach to trade. At the same time, the Tax Cuts and Jobs Act of 2017 reduced corporate tax rates and altered international tax rules, with the aim of encouraging domestic investment and repatriation of profits.

Markets responded positively to tax cuts but were unsettled at times by unpredictable trade announcements and confrontational rhetoric. Trump's tenure underscores how presidential communication and policy unpredictability can affect risk premiums, supply chain strategies, and capital flows, even when headline economic growth remains solid. Analysts at organizations such as the Council on Foreign Relations and the OECD have extensively documented these dynamics, which continue to influence corporate planning in 2026.

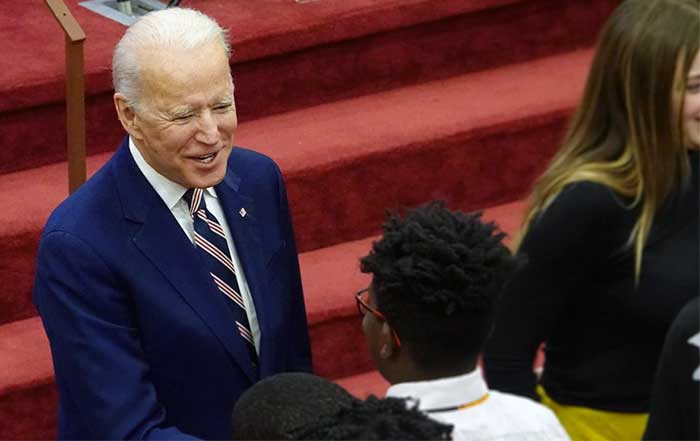

Joe Biden: Post-Pandemic Recovery, Industrial Policy, and Climate Transition

The Biden administration, entering office amid the COVID-19 pandemic, prioritized large-scale fiscal support, public health measures, and a renewed focus on infrastructure and climate. Legislation such as the American Rescue Plan, the Infrastructure Investment and Jobs Act, and the Inflation Reduction Act combined immediate relief with long-term investment in transportation, broadband, clean energy, and advanced manufacturing. The CHIPS and Science Act further signaled a strategic industrial policy aimed at strengthening domestic semiconductor production and reducing reliance on vulnerable global supply chains.

These initiatives illustrate a shift toward more active federal involvement in shaping sectoral outcomes, particularly in energy, technology, and strategic manufacturing. For readers following developments in technology and energy, Biden's presidency demonstrates how executive leadership, aligned with congressional majorities, can reorient capital allocation and innovation priorities in ways that affect not only U.S. competitiveness but also policy responses in Europe, Asia, and other regions.

Presidential Economic Power Timeline

How U.S. Presidents Have Shaped the Economy (1930s-2020s)

The Limits of Presidential Control in a Complex Global Economy

The Independence and Centrality of the Federal Reserve

While presidents often receive credit or blame for inflation and interest rates, these core macroeconomic levers are controlled by the Federal Reserve, whose independence is a cornerstone of U.S. economic governance. The Fed's dual mandate-to achieve maximum employment and stable prices-requires it to adjust monetary policy based on data and long-term assessments rather than short-term political pressures.

In the aftermath of the pandemic, the Fed's rapid tightening cycle to combat inflation highlighted the institution's willingness to act even when higher rates complicate presidential economic agendas. Although presidents appoint Fed leadership, any overt attempt to influence day-to-day decisions risks undermining market confidence and could trigger adverse reactions in bond markets and exchange rates. For global investors, the credibility of the Fed, documented through its communications and minutes available at federalreserve.gov, is as important as the fiscal stance of the White House.

Congress, Polarization, and Policy Gridlock

In 2026, political polarization in Washington remains a defining feature of the policy environment. Divided government, narrow majorities, and ideological fragmentation within parties can all impede presidential initiatives, from tax reform and immigration policy to infrastructure investment and regulatory changes. Even when presidents articulate ambitious economic agendas, implementation often requires painstaking negotiation and compromise, and in some cases, prolonged stalemates that delay or dilute reform.

For businesses and workers tracking developments via usa-update.com/employment.html and usa-update.com/regulation.html, this means that the timing and content of policy changes are frequently uncertain. Corporate strategies must therefore incorporate scenario planning that accounts for multiple potential legislative outcomes rather than assuming a presidential proposal will be enacted as announced.

Global Shocks, Supply Chains, and Energy Markets

The COVID-19 pandemic, Russia's invasion of Ukraine, and ongoing tensions in the Middle East and Indo-Pacific have all demonstrated how global shocks can override domestic policy intentions. Disruptions to supply chains, surges in commodity prices, and shifts in trade patterns are often driven by events outside the direct control of any U.S. administration.

Energy markets are a prime example. While presidents can influence domestic production through regulation, leasing policies, and support for renewables, global oil and gas prices are heavily affected by decisions of producers' groups such as OPEC and by geopolitical risk. Similarly, efforts to promote reshoring or "friend-shoring" of manufacturing must contend with complex international networks that have been built over decades. Institutions such as the International Energy Agency and the World Trade Organization provide insight into these dynamics, which are regularly interpreted for a U.S. audience at usa-update.com/international.html.

Communication, Confidence, and Market Psychology

The Power of Presidential Messaging

Beyond formal powers, presidents exert significant influence through communication. Statements on economic conditions, policy priorities, and international relations are closely monitored by investors, businesses, and foreign governments. Markets often react not only to the substance of policy but also to the tone, consistency, and credibility of presidential messaging.

During periods of stress, such as the 2008 financial crisis or the early months of the pandemic, clear and reassuring communication from the White House can stabilize expectations and reduce panic. Conversely, contradictory or inflammatory rhetoric can increase volatility, widen credit spreads, and dampen investment. The experience of Franklin D. Roosevelt's "fireside chats," John F. Kennedy's handling of Cold War tensions, and more recent episodes of real-time communication via social media all illustrate how the presidency functions as a focal point for economic sentiment.

For the readership of usa-update.com/news.html, which closely follows both policy announcements and market reactions, this underscores the importance of evaluating not just what presidents decide, but how they explain and justify those decisions to domestic and international audiences.

International Confidence and the Dollar's Central Role

The United States remains the issuer of the world's primary reserve currency, and U.S. Treasury securities are widely viewed as the benchmark safe asset. This status gives the president a unique platform in global economic affairs but also imposes responsibilities. Foreign central banks, sovereign wealth funds, multinational corporations, and institutional investors all monitor U.S. political stability, fiscal trends, and policy coherence when deciding how much exposure to maintain in dollar-denominated assets.

When presidential actions raise doubts about fiscal discipline, rule of law, or respect for institutional independence, risk perceptions can shift, potentially affecting borrowing costs and capital flows. Conversely, credible commitments to long-term stability and openness can reinforce the dollar's role and attract investment, even amid short-term volatility. Analysis from the Bank for International Settlements and IMF highlights how these perceptions shape the global financial architecture that underpins everything from mortgage rates in the United States to infrastructure financing in Africa or Southeast Asia.

Sectoral Impact: Where Presidential Decisions Matter Most

Energy, Climate, and Industrial Transition

Energy policy sits at the intersection of economic performance, national security, and environmental responsibility. Over the past two decades, the contrast between George W. Bush's emphasis on fossil fuel development, Barack Obama's support for renewables, Donald Trump's deregulatory focus on traditional energy, and Joe Biden's climate-centric industrial policy has shown how each administration can alter incentives for investment, production, and innovation.

In 2026, the United States is in the midst of a complex transition: expanding renewable capacity, upgrading grids, deploying electric vehicles, and investing in hydrogen, carbon capture, and other emerging technologies, while still relying on oil and gas for a significant share of its energy needs. Presidential decisions on tax credits, environmental standards, permitting reform, and international climate commitments directly affect capital allocation in sectors from utilities and automotive manufacturing to heavy industry and real estate.

Readers can follow these developments in depth through usa-update.com/energy.html, while global context is available from organizations such as the International Energy Agency and the UN Framework Convention on Climate Change.

Technology, Data, and Innovation Leadership

The United States continues to compete with China, the European Union, Japan, South Korea, and others for leadership in advanced technologies such as artificial intelligence, quantum computing, biotechnology, and next-generation communications. Presidential strategies in this domain typically combine research funding, export controls, immigration policy for high-skilled workers, and regulation of data and digital markets.

Recent initiatives, including the CHIPS and Science Act, restrictions on certain technology exports to China, and debates over AI governance, illustrate how the presidency can shape the innovation ecosystem and the competitive landscape for firms in Silicon Valley, Austin, Boston, and emerging tech hubs across North America, Europe, and Asia. For companies, investors, and job seekers tracking these shifts, usa-update.com/technology.html provides ongoing coverage, while institutions such as the National Science Foundation and OECD offer comparative data on research and innovation trends.

Jobs, Labor Markets, and Workforce Transformation

Employment remains the most visible indicator by which many citizens judge presidential performance. Yet in 2026, labor markets are being reshaped by automation, remote work, demographic shifts, and sectoral realignments. Presidents can influence employment through infrastructure programs, education and training initiatives, minimum wage policy, immigration rules, and support for specific industries, but they cannot fully control the structural forces driving demand for certain skills and occupations.

From Franklin D. Roosevelt's public works programs to Joe Biden's infrastructure and manufacturing investments, presidential initiatives have aimed to create or preserve jobs, often with an eye toward specific regions or sectors. However, the long-term trajectory of employment increasingly depends on how effectively workers can transition between roles and industries, and how well public and private institutions coordinate reskilling and lifelong learning. Readers focused on career planning and labor trends can explore these issues at usa-update.com/jobs.html and usa-update.com/employment.html, alongside research from the U.S. Bureau of Labor Statistics.

Finance, Regulation, and Consumer Protection

The financial sector is both a transmission channel for presidential policy and a source of independent risk. Regulatory frameworks, capital standards, consumer protection rules, and enforcement priorities all shape how banks, asset managers, fintech firms, and credit providers operate. The contrast between the Dodd-Frank Act under Barack Obama and subsequent deregulatory moves under Donald Trump highlighted the pendulum-like nature of financial governance, while the turbulence in certain banking segments in the early 2020s reminded policymakers that systemic risk can reemerge in unexpected forms.

In 2026, debates continue over the appropriate regulation of digital assets, the role of non-bank financial institutions, and the balance between innovation and stability. Presidential appointments to agencies such as the SEC, CFTC, and CFPB are central to these debates, influencing everything from disclosure requirements and enforcement intensity to the treatment of emerging financial technologies. Coverage at usa-update.com/finance.html and usa-update.com/consumer.html helps readers understand how these regulatory shifts affect borrowing costs, investment options, and consumer rights.

The President as Global Economic Strategist

Trade, Alliances, and Strategic Competition

In a multipolar world where China, the European Union, India, and regional powers across Asia, Latin America, and Africa are asserting greater influence, the U.S. president functions as a global economic strategist as much as a domestic policymaker. Trade agreements, tariffs, export controls, and investment screening mechanisms are now viewed not only through the lens of growth and efficiency but also national security and resilience.

The evolution from NAFTA to USMCA, the U.S. withdrawal from the Trans-Pacific Partnership (TPP), and the intensifying U.S.-China rivalry over technology and supply chains demonstrate how presidential decisions can reconfigure global trade architecture. For firms operating in Canada, Mexico, Germany, Japan, South Korea, Singapore, and beyond, these shifts require constant reassessment of sourcing, production, and market strategies.

Readers interested in the intersection of trade, security, and diplomacy can follow developments at usa-update.com/international.html, while organizations such as the World Trade Organization and CFR provide in-depth analysis of the evolving global order.

Sanctions, Financial Statecraft, and Geopolitics

Sanctions have become a key tool of U.S. foreign policy, allowing presidents to exert pressure on adversaries without direct military confrontation. Measures targeting Russia, Iran, North Korea, and other actors have restricted access to dollar funding, frozen assets, and limited trade in strategic goods. While sanctions are often justified on security or human rights grounds, they also have significant economic implications for energy markets, financial systems, and multinational corporations.

The effectiveness of sanctions depends on coordination with allies in Europe, Asia, and other regions, as well as on the centrality of the dollar-based financial system. The more the United States uses its financial leverage for strategic purposes, the greater the incentive for some countries to seek alternatives, whether through regional payment systems, digital currencies, or non-dollar trade arrangements. Monitoring by institutions such as the SWIFT cooperative and research from think tanks like the Atlantic Council helps businesses understand how presidential decisions in this domain may affect cross-border transactions and risk exposure.

Trust, Legacy, and the Future of Presidential Economic Power

Experience, Expertise, and Institutional Credibility

In 2026, the complexity of the global economy places a premium on experience, expertise, and institutional coordination within the executive branch. Presidents rely on teams of advisors, including the Council of Economic Advisers, the National Economic Council, and interagency task forces, to design and implement policy. The quality of these teams-measured by their technical competence, understanding of markets, and ability to communicate with stakeholders-directly affects the credibility of the administration's economic strategy.

For a business audience, the perceived competence of a president's economic team can be as important as partisan affiliation. Markets tend to reward administrations that provide clear frameworks, respect data and analysis, and work constructively with the Federal Reserve, Congress, and international partners. Conversely, ad hoc or ideologically rigid approaches that disregard expertise can raise uncertainty and risk premiums.

The Intangible Currency of Confidence

Ultimately, the presidency operates not only with legal authority but also with an intangible currency: trust. Historical figures such as Franklin D. Roosevelt, Dwight D. Eisenhower, Ronald Reagan, and Barack Obama are often remembered as much for their ability to reassure and inspire as for specific policy measures. In contrast, periods of economic anxiety or political turmoil frequently reveal the limits of presidential power when trust erodes.

In 2026, as the United States navigates challenges including high public debt, demographic aging, technological disruption, and geopolitical rivalry, the capacity of any president to sustain confidence-among citizens, businesses, and international partners-will be central to economic resilience. This involves not only responding to crises but also articulating a credible long-term vision for competitiveness, inclusion, and sustainability.

Implications for Readers and Decision-Makers

For the audience of usa-update.com, spanning executives, professionals, investors, job seekers, and informed citizens across the United States, North America, and key global regions, the key takeaway is that presidential power over the economy is substantial yet bounded. Presidents shape direction through budgets, regulation, appointments, diplomacy, and communication, but outcomes are filtered through institutions, markets, and global forces.

Understanding this balance equips decision-makers to interpret policy announcements with realism rather than either undue optimism or unwarranted pessimism. It encourages businesses to diversify risk, investors to look beyond political cycles, workers to focus on adaptable skills, and consumers to recognize the interplay between national leadership and global trends.

As the world moves deeper into the second half of the 2020s, usa-update.com will continue to track how the occupant of the White House navigates this complex landscape-across economy, business, finance, jobs, international affairs, energy, and beyond-providing readers with the analysis needed to understand not only what presidents attempt, but what they can realistically achieve in shaping the economic fortunes of the United States and the wider world.